The Surroundup

WHAT TRADE WAR?

- by Adil Mohammed, CFP®, CIM®, FCSI®

- July 29, 2025

Here we are—already the end of July.

I could’ve sworn summer just started, then I blinked and suddenly everyone’s talking about their end-of-summer plans. Where does the time go? It feels like just yesterday I was advising clients to keep their expectations in check heading into 2025… and now analysts are already looking ahead to 2026. You know what they say—once you start saying things like “Can you believe it’s July already?”, you’ve officially crossed into middle age.

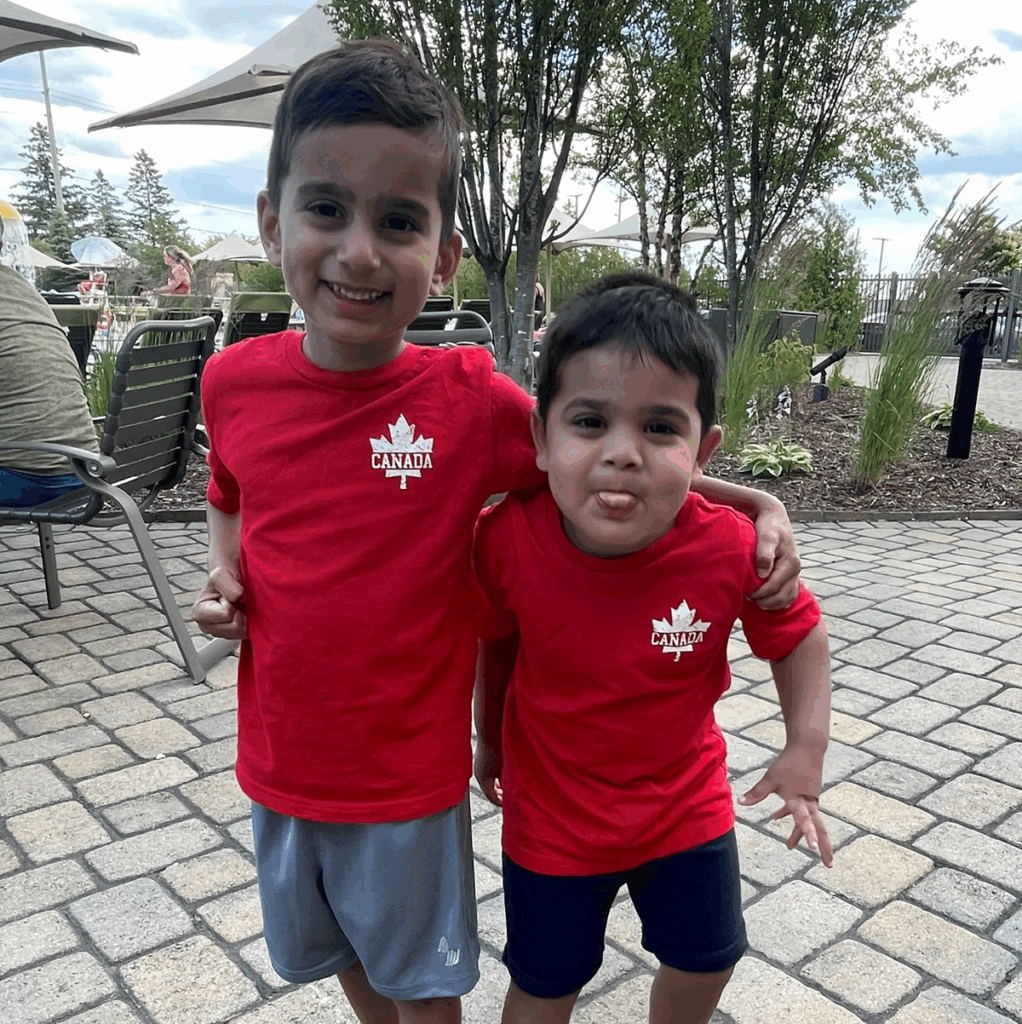

Honestly though, it’s not just 2025 flying by—the last five years have felt like a blur. Granted, I did have two kids during that time, but still… wasn’t it just yesterday we were all in lockdown? Since becoming a parent, the passing of time has never felt more real—or more relentless.

One day they were:

Now look at them:

As the saying goes – the days are long but the years are short.

If you’ve been blissfully unplugged for the last six months (honestly, good for you) and are just now seeing headlines about the stock market hitting new highs, you might assume it’s been smooth sailing—nothing to see here. But that couldn’t be further from the truth.

Here’s what you need to know:

2025 RECAP

This quote from The Wall Street Journal, “The U.S. Economy Is Regaining Its Swagger” says it all:

“When President Trump slapped tariffs on nations across the globe this spring, many economists feared higher prices and spending cuts would flatten the economy. Consumer sentiment collapsed, the S&P 500 fell by 19% in two months. The world held its breath and waited for the bottom to drop out—but that didn’t happen. Now, businesses and consumers are regaining their swagger, and evidence is mounting that those who held back are starting to splurge again.”

In other words, the market got off to a strong start in 2025. However, volatility crept in by late February and early March, driven by renewed fears of a slowing economy and potential trade disruptions. Then came the dramatic moment: Trump’s “Liberation Day” tariff announcement, which sent markets sharply lower. But, in classic fashion, he reversed much of the announcement shortly afterward—prompting the rise of what traders jokingly dubbed the TACO trade: Trump Always Chickens Out.

That reversal, combined with a surprisingly resilient economy and a rebound in consumer and business confidence, fueled one of the fastest market recoveries in modern history—pushing major indexes back to new highs.

Here are my 5 takeaways from the first half of 2025.

TAKEAWAY #1:

MARKETS HAVE MOVED ON FROM THE HEADLINES – MAYBE YOU SHOULD TOO

If I told you that Donald Trump was picking fights around the globe and that the conflict in the Middle East had expanded to Lebanon and Iran — would you have guessed the stock market would be hitting its 12th all-time high?

Just a few months ago, the headlines screamed of economic meltdown. Now? Silence. What changed?

Enter the TACO trade — short for Trump Always Chickens Out. This phrase describes a familiar pattern: bold declarations from Trump, typically around tariffs or foreign policy, followed by walk-backs, delays, exemptions, or full reversals. Markets have seen this playbook before and have learned not to overreact.

Much like the boy who cried wolf, repeated bluster without follow-through has trained investors to tune out the noise. And in 2025, the same applies to geopolitical drama. Yes, there’s initial volatility — but markets have become skilled at looking through it.

Despite constant geopolitical flare-ups and political chaos, stocks continue to march higher, not because these things don’t matter but because there are many more market forces at play like company fundamentals, earnings, innovation, and capital flows.

The lesson?

Knee-jerk reactions to every headline rarely pay off. Staying focused on long-term strategy rather than daily sensationalism is what separates investors from speculators.

For now, markets have learned to look past the panic—maybe it’s time you did too.

TAKEAWAY #2:

DIVERSIFICATION IS PAYING OFF IN 2025

While U.S. markets have dominated headlines in recent years, 2025 is shaping up as a reminder that diversification still works.

Despite ongoing tariff rhetoric and geopolitical noise, international markets — particularly Canada, Europe, and even China — are outperforming the U.S. this year.

It’s a valuable lesson: diversification doesn’t always feel rewarding in the short term, especially when one region (like the U.S.) leads for several years. But we diversify precisely for times like this — when leadership shifts and opportunities emerge in different parts of the world.

Spreading investments across geographies helps manage risk, smooth out returns, and ensure we’re not overly exposed to any single market narrative.

This year is a great example of why staying globally diversified remains a core part of a resilient investment strategy.

TAKEAWAY #3:

THE MARKET WAITS FOR NO ONE

The sharp volatility we experienced in April — followed by an equally swift and powerful recovery — offered yet another clear reminder that market timing simply doesn’t work.

When the “Liberation Day” tariffs were announced, plenty of people had their “I told you so” moment, confident that the downturn was just beginning.

But where are they now, with markets hitting multiple all-time highs? Do we really think they felt better a week later and jumped back in? Highly unlikely.

And what about those who thought they had time — that they’d re-enter the market when things felt more comfortable?

That moment never came, and the rally left them behind.

Markets are forward-looking; they bottom when fear is at its peak, not when everything feels calm. Waiting for clarity or comfort usually means missing the upside. And remember, market timing isn’t just about getting out — it requires being right twice: knowing when to exit and when to re-enter.

In my experience, those who got out are either still on the sidelines or re-entered after the rebound.

It’s yet another example of why staying invested — even when it’s uncomfortable — is a far better long-term strategy than trying to time the market.

TAKEAWAY #4:

IT’S NOT ABOUT GOOD OR BAD, IT’S ABOUT BETTER OR WORSE

You’re likely asking yourself: how can markets be hitting all-time highs with so much uncertainty in the world?

Between escalating geopolitical conflicts, a trade war that continues to simmer, a potential resurgence in inflation, the disconnect seems hard to understand.

But here’s the key — markets don’t trade on whether things are good or bad. They trade on whether things are getting better or worse.

To put this in perspective, U.S. consumer sentiment in April dropped to its second-lowest level on record since 1952 — even lower than during the 2022 bear market, the COVID-19 pandemic, and the Great Recession of 2008 (CNN, April 2025).

And yet, the world didn’t end — it stabilized.

And in the market’s eyes, that’s better than expected.

That’s what markets do — they overreact, they hit extremes, on both ends — the up and the down.

As I’ve said before in past videos, markets eventually price in the maximum amount of bad news and pessimism. Once that happens, it doesn’t take good news to move markets higher — just news that’s less bad.

This dynamic is playing out in real time once again.

TAKEAWAY #5:

THE AI TRADE IS LIVE AND WELL

If there’s one theme that continues to prove its strength in 2025, it’s the AI trade.

Often compared to the rise of the internet or the mobile phone — even called the next industrial revolution — AI remains a dominant force in markets.

Companies like Meta (a.k.a. Facebook) aren’t worried about overspending on AI infrastructure; their greater concern is not investing enough.

The AI hyperscalers — the major players building the infrastructure behind this revolution — were key drivers of the market’s strength in 2023 and 2024, and they continue to lead the charge this year.

Earlier in 2025, when China’s DeepSeek made headlines by matching U.S. AI performance at a fraction of the cost, many questioned whether the U.S.-led AI trade had peaked.

AI stocks did stumble briefly, but they’ve since come roaring back — proving that investor conviction remains strong.

The surge in capital expenditures in this space is a clear sign: no one is tapping the brakes.

While it’s likely we’ll hit some bumps along the way or see signs of overspending at some point, 2025 has reinforced one key takeaway — this AI trend still has legs.

FIVE YEARS, COUNTLESS CHALLENGES – ONE CONSTANT: RESILIENCE

If there’s one word that captures the past five years, it’s resilient.

We’ve lived through a global pandemic, five bank failures, two wars, sky-high inflation, rapid-fire interest rate hikes, a U.S. credit rating downgrade, and a long list of geopolitical flare-ups.

And yet — against all odds — the economy and markets have kept chugging along.

When inflation spiked and rates surged, the textbook said the consumer would crack and a recession would hit in 2023.

This year, tariffs were expected to tip the economy into contraction, but once again, the consumer and broader economy are defying expectations.

Just last month, retail sales showed continued strength, and this morning’s U.S. initial jobless claims came in at 217,000 — the lowest reading since mid-April — signaling a labour market that remains solid.

Similar to the line in Jurassic Park, “life finds a way” — and so do corporations and consumers.

As I’ve said many times, the most important driver of markets is earnings — and companies continue to find ways to grow them.

Q1 earnings were strong, and so far, Q2 results are holding up.

Of course, nothing lasts forever and risks always remain. But for now, the market, the consumer, and — most importantly — corporate profitability continue to stand strong, a testament to the remarkable resilience we’ve seen time and again.

WHERE DO WE GO FROM HERE:

So where do we go from here?

On one hand, we’re entering a seasonally weaker stretch for markets — August through October has historically brought more volatility. Valuations remain elevated, consumer sentiment is getting frothy, and there are early signs of euphoria creeping in.

At the same time, markets seem to have largely priced in tariff uncertainty as a non-issue, either assuming this is “big talk”, and they won’t take effect or that deals will get done without major consequences.

That kind of setup leaves little room for error.

As I said at the start of the year: temper your expectations.

If some of these tariffs do come into play — or other negative headlines hit — a market pullback wouldn’t be surprising, and in fact, could be healthy.

On the flip side, if trade deals get done, earnings remain solid, the economy holds up, and we begin to see more pro-market policies from Trump, such as tax cuts or deregulation, then this rally could very well continue.

The truth is, I don’t know which path unfolds — no one does.

Whatever comes next, we’ll face it the way we always do — with perspective, patience, and a plan.

We’re here to help you stay grounded and stay the course.

Adil Mohammed, CFP®, CIM®, FCSI®

Wealth Advisor

Assante Financial Management Ltd.

P.S – You can find everything I’ve written or filmed going back to 2018 by going to www.surroundwealth.com ➜ click “what we think” ➜ filter by author.

The opinions expressed are those of the author and not necessarily those of Assante Financial Management Ltd. This material is provided for general information and the opinions expressed and information provided herein are subject to change without notice. Every effort has been made to compile this material from reliable sources however no warranty can be made as to its accuracy or completeness. Before acting on the information presented, please seek professional financial advice based on your personal circumstances. Insurance products and services are provided through Assante Estate and Insurance Services Inc.