The Surroundup, Videos

ARE YOU PLANNING FOR A 100-YEAR LIFE? HERE’S WHY YOU SHOULD BE

- by Gillian Stovel Rivers, MA, CFP®, CEA

- September 25, 2025

I’ll be honest: I spend a lot of time—and not a small amount of money, energy and attention—trying to stay healthy. Not in an obsessive Bryan Johnson kind of way, but in a conscious, daily-practice kind of way. My supplements are personalized. My workouts are tracked. I walk 10,000 steps most days, hit my zone 4-5 minutes each week, lift weights every day except Monday, and I am one of the most exuberant proponents of daily cold plunging you will ever meet (jury’s still out, but I’m in it for the dopamine).

I recently acquired the brand spanking new WHOOP 5.0 MG which tells me every Sunday morning how old I am as compared to my chronological age, and how fast I am aging as compared to last week.

In May, prior to some busy time travelling and a slew of late-night work and family events, I told the world on LinkedIn how I felt like I’d won the lottery when I learned I was tracking 10.8 years younger than my actual age, and clocking 0.8 years per calendar year, aging much slower than real time.

Since that time, there were spans of time where I found I had given up some ground on my WHOOP age, and suddenly I was aging faster than one year per year. Yikes! Every single one of the daily habits matters, the most important of which if you can believe it is sleep!

But here’s the part that matters most: I’m not doing any of it to live forever, or to Benjamin Button my way back to red hair in pig tails. I’m doing it so that my joy doesn’t run out before my money does, or vice versa. Because what’s the point of living to 98 if you’re too frail to travel, play with your grandkids, or enjoy your wealth?

And that brings us to a reality that’s not just personal anymore—it’s universal. If you’re in your 50s, 60s, or even early 70s, and living in North America, there’s a good chance you’ll live into your 90s. If you’re affluent and health-conscious, like many of my clients, 100 is not out of the question.

The question is: Are you planning for that?

The Rising Odds of a 100-Year Life

Here’s what we know: Life expectancy is growing—and not equally.

A 2024 Brookings Institution study found that the richest 10% of Americans live 10 to 15 years longer than the poorest 10%. In Canada, similar trends are emerging. Wealth buys access to better healthcare, safer environments, fitness routines, therapy, better food—and it’s showing up in the data.

If you’re reading this and you’re in the top income brackets, your financial reality isn’t average. Neither is your life expectancy.

But here’s the catch: Longer lives come with longer risks. And in many cases, they’re not financial first—they’re physical and emotional.

The Healthspan Dilemma

You’ve probably heard this before, but it bears repeating: Lifespan isn’t the same as healthspan.

According to Harvard Health, the average person spends the last 8 to 10 years of their life in poor health. There are even studies showing how the mind body connection during this 8 to 10 year decline is itself a battle, one where the internal dialogue can often become a continuous and gradual letting down rather than a fortification or building up. This internal battle might mean cognitive decline, lack of mobility, or chronic illness—and it means a decade where joy, freedom, and independence are at risk. That’s a decade of potential long-term care costs, stress on family, and limitations on how you live and what you can spend.

And that’s why I see investing in health as a form of wealth planning. They aren’t separate. They are co-pilots. Just like you might review your investment portfolio quarterly, I’d argue we need to be reviewing our physical, emotional, and social wellness just as frequently.

What the Rest of the World Can Teach Us

Let’s step outside the North American mindset for a second.

In Japan, where over 90,000 people are now over the age of 100, they take a very different approach to aging. There’s a cultural belief in “ikigai”—your reason for getting up in the morning. It’s a blend of purpose, contribution, and daily practice. Combine that with their emphasis on movement, community connection, and low-stress social norms, and you start to understand why Japan leads the world in healthy aging.

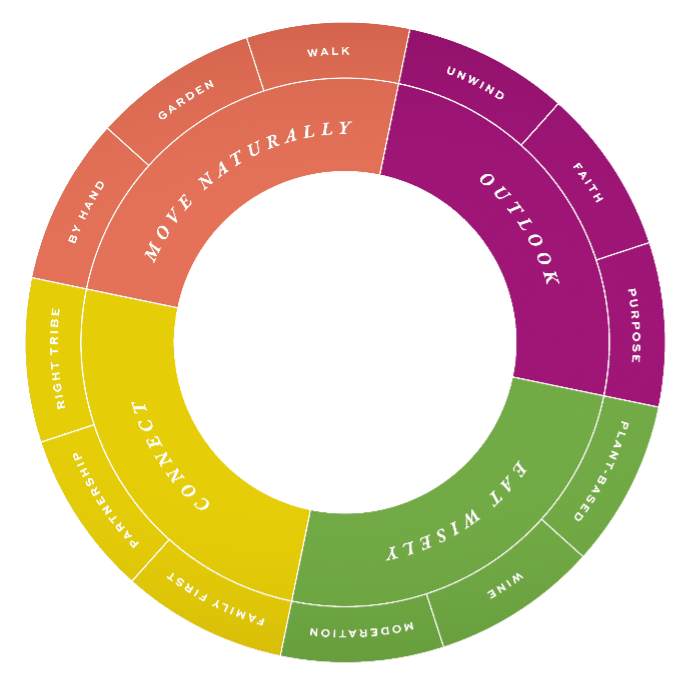

Or take the “Blue Zones”—the five regions of the world identified by author and explorer Dan Buettner where people live measurably longer, healthier lives. In places like Sardinia (Italy), Ikaria (Greece), Nicoya (Costa Rica), Loma Linda (California), and Okinawa (Japan), the secret isn’t expensive medicine. It’s:

- Natural movement throughout the day

- Strong social bonds

- A plant-forward diet

- A sense of purpose

- And crucially: Low financial stress

If you haven’t watched it yet, I highly recommend the Netflix documentary Live to 100: Secrets of the Blue Zones. It’s a gentle, eye-opening look at what really matters for long-term wellbeing—and it’s probably not what your doctor told you in your annual checkup.

North American Catch-Up: What We’re Doing Right—and What We’re Missing

Back at home, there’s good news too and a lot of it is baked right into the businesses and resources that have become democratized and publicly available as the need for them has grown.

The rise of concierge medicine, personalized longevity clinics, and biohacking influencers like Peter Attia, Andrew Huberman, and David Sinclair is creating more awareness—and action—among people who want to live better, not just longer.

Attia’s book Outlive (which I highly recommend) outlines what he calls the “Centenarian Decathlon”: a framework to prepare physically and mentally for the last decade of life. His message? Don’t just try to extend life. Train for it, like you would a marathon. That includes strength training, cardiovascular health, cognitive resilience, and emotional wellness. I personally thrive on ideas like this because they break down to something small I can do every single day and in doing them, I feel the benefits as well as a sense of control over my destiny.

On the financial side, advisors like me are starting to shift the conversation away from “Can I retire at 65?” to:

- How long might I live?

- What does it cost to live well that long?

- How do I plan for care, dignity, independence, and joy in my 90s?

- And what can I start doing today that will allow me to flourish as I age?

It’s a new conversation—and it’s one I believe every affluent Canadian over 50 should be having right now.

Three Key Planning Shifts to Make Now

If this is resonating, here are three practical things to think about:

1. Plan for 100

Our financial plan includes scenarios that stretch to age 98 or 100, not just 85 or 90. This isn’t pessimism—it’s realism for many in your demographic. A longer timeline affects your withdrawal rates, estate planning, and how you structure income in your later decades.

2. Health is a Retirement Asset

Start thinking of your physical and mental health as part of your financial plan. It’s a multiplier—the healthier you are, the more optionality you preserve in how you live, where you live, and what you can do.

Want a helpful exercise? List your top 5 values for retirement (e.g. travel, family, freedom, adventure, contribution) and ask: What would it take—physically and financially—to protect those things to age 95?

3. Don’t Wait for Crisis to Plan for Care

Long-term care conversations are often awkward—but ignoring them doesn’t make them disappear. Planning ahead means deciding how you want to live if your health declines, whether that’s private home care, moving closer to family, or securing the right insurance or investment vehicles.

Statistically, 70% of people over 65 will need some form of long-term care, and costs in Canada can range from $3,000–$10,000/month depending on the level of care and location.

The Wealth of a Life Well-Lived

At the end of the day, the goal isn’t just to live longer—it is to flourish in every sense of the word.

I believe the future of retirement planning is deeply interdisciplinary. It’s about making sure your investments, your body, your brain, and your sense of joy are all set up to thrive together for decades to come.

So whether you’re rethinking your retirement, starting to explore long-term care options, or just curious about how to stretch your healthspan and wealthspan—this is your moment.

And if you haven’t yet seen it, watch Limitless with Chris Hemsworth on Disney+. It’s a fantastic, entertaining docuseries on what it really takes to push the boundaries of aging well, and it explores everything from fasting to memory training to facing mortality with strength and clarity.

In Closing

If you’ve learned anything by watching me work for the last two decades and as we’ve collectively learned from the last decade of research into longevity, it’s this:

- The body is adaptable

- The mind is trainable

- And wealth is not just measured in dollars—but in time, energy, and joy

So here’s to living long, and living well. May your plans support both.

If you’re ready to update your financial plan to reflect a 100-year life, or to explore how your health and wealth can work together more intentionally, that’s my wheelhouse. Just ask.

PS: here are some further citations that might interest you!

- Brookings Institution (2024): Life expectancy gap by income level in the U.S.

- Public Health Agency of Canada (2023): Disparities in healthy aging by socioeconomic status.

- Harvard Health Publishing (2023): Healthspan versus lifespan.

- Schroders Global Investor Study (2023): Retirement preparedness and longevity perception gaps.

- OECD Reports on Aging (2023): Sweden and Denmark’s integration of health into retirement benefits.

- World Health Organization & National Institute of Health: Global aging trends and Blue Zone strategies.

Gillian Stovel Rivers, MA, CFP®, CEA

Senior Wealth Advisor

Assante Financial Management Ltd.

Gillian Stovel Rivers is a Senior Wealth Advisor with Assante Financial Management Ltd. The opinions expressed are those of the author and not necessarily those of Assante Financial Management Ltd. Please contact her at (905) 335-1950 or visit www.surroundwealth.com to discuss your particular circumstances prior to acting on the information above.