Blog

ASSANTE MARKET UPDATE: EXPECT VOLATILITY

- by Adil Mohammed, CFP®, CIM®, FCSI®

- September 9, 2024

Surround Friends and Family,

You’ve heard me say it many times – market corrections are normal, necessary, and part of the plan. If you want the long-term returns of the market, you must go through the short-term ups and downs – that’s how it works. Last week was a volatile one and the question is whether this is the start of a more meaningful pullback or simply a hiccup that will be forgotten in days.

Regardless, I’d argue that we should expect a market correction and here’s why:

HISTORY

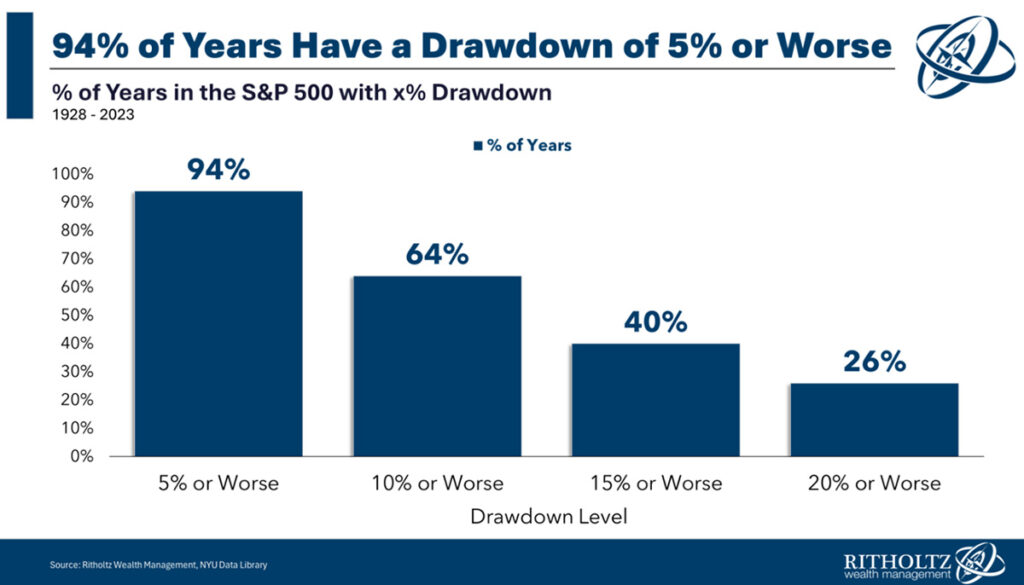

- History says that in 64% of years, the market should experience a 10%+ correction.

- To date we’ve experienced about a 6% correction in April and an 8% in August.

SEASONALITY

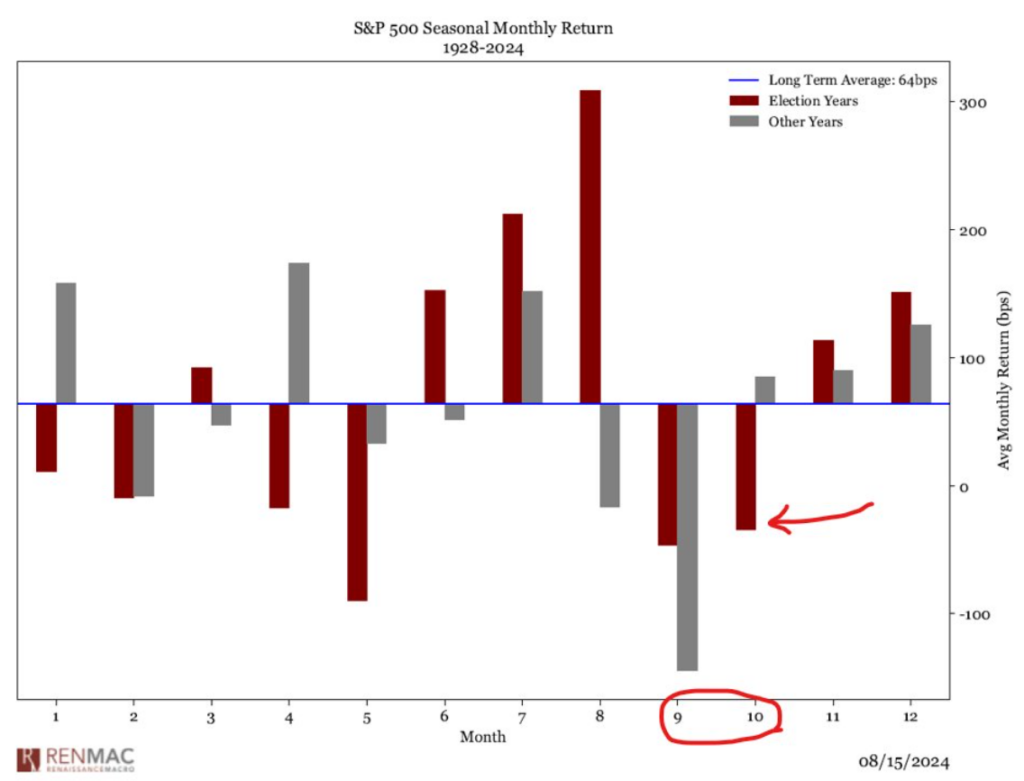

Market seasonality is not on our side. September tends to be a negative month historically and in a US election year, that trend continues into October. That said, the trend typically reverses into year-end once the election is decided.

For more on the upcoming election and how it may affect your portfolio, click here.

VOLATILITY: WHAT GOES UP MUST COME DOWN

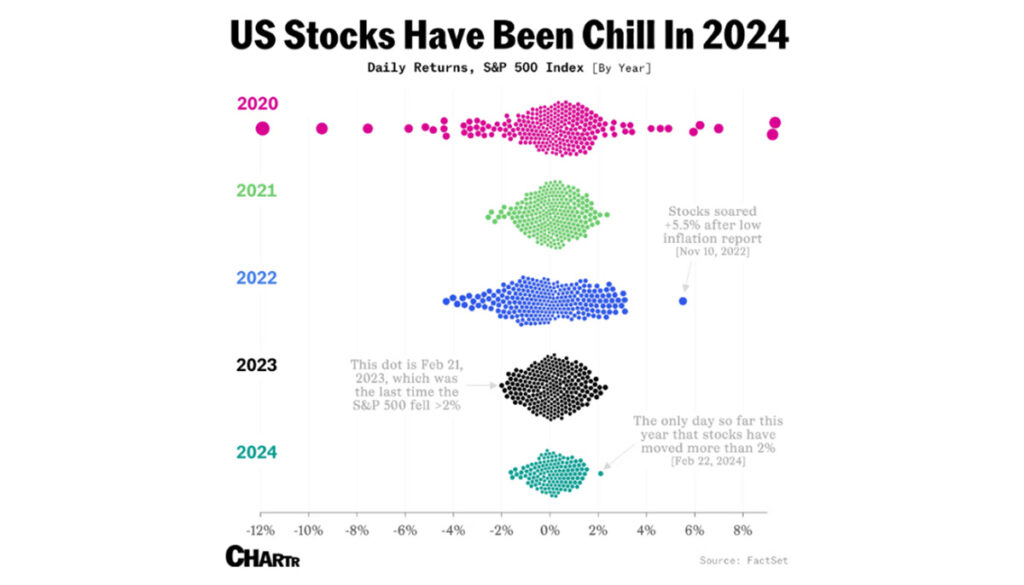

Periods of low volatility tend to be followed by periods of high volatility.

2018 = high volatility

2019 = low volatility

2020 = extremely high volatility

2021 = low volatility

2022 = high volatility

2023 = low volatility

2024 = low volatility (so far)

In fact, we experienced 356 trading days (Feb 21, 2023 to June 24, 2024) without seeing a one-day drop of at least 2% (the average is 29 days). Given that we are currently in a state of low volatility, we may be due for a period of high volatility.

MARKETS HAVE HAD A STRONG RUN

- Besides a shallow pullback in April, the first half of the year was smooth sailing.

- There were 31 all-time closing highs in the US market as of June 30th.

- This strong performance (particularly in AI/tech) has led to historically higher allocations to stocks along with stretched equity valuations.

Combine all these elements with the fact that a lot of good news has been priced into markets and we get a market that could be poised for a pullback.

PERSPECTIVE

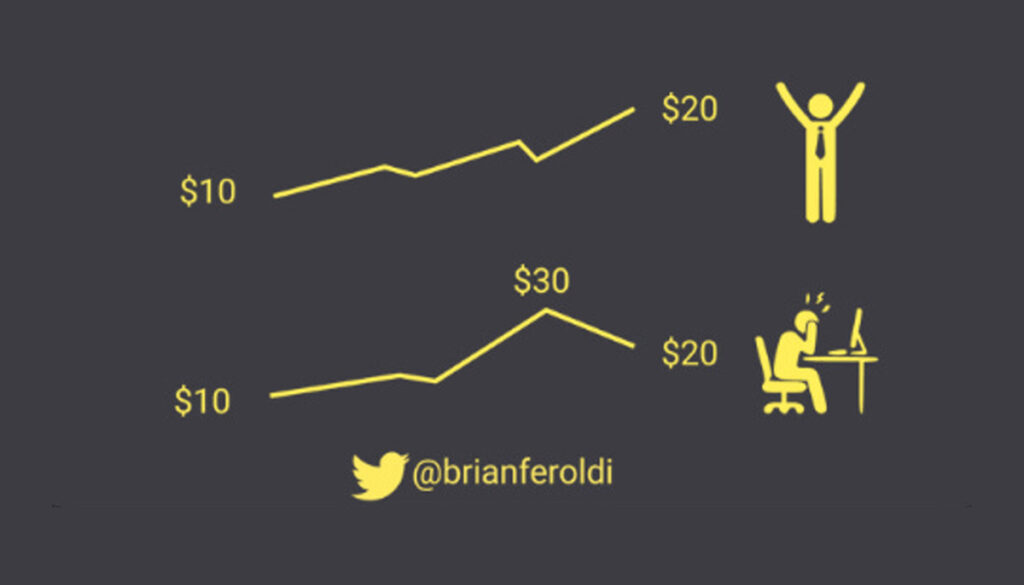

Regardless of whether this is a meaningful correction or a blip in the road, remember:

1. On average the market drops 14% at some point during the year, but 75% of the time, annual returns are positive.

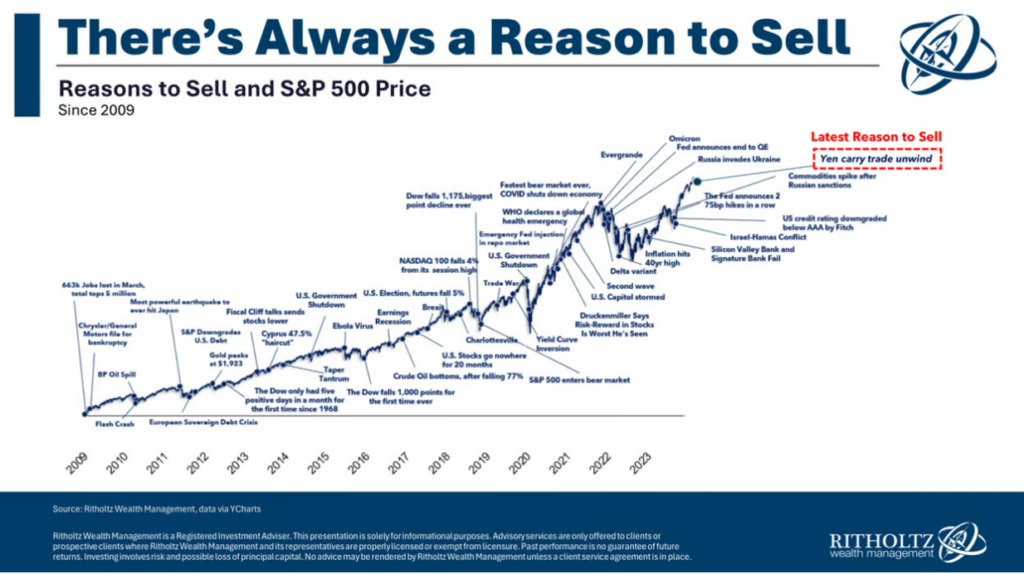

2. There will always be a reason to worry, yet the market continues to trend higher regardless.

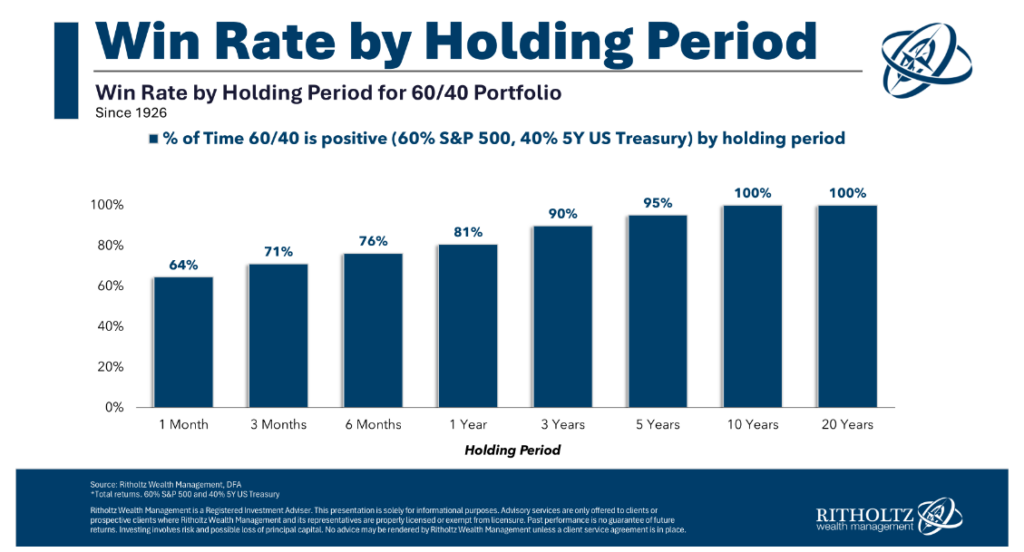

3. Over the long term, markets are undefeated. Stick to the plan and you have a high probability of being rewarded.

Bottom line – look past the potential bumpiness, focus on what you can control and stick to the plan.

The opinions expressed are those of the author and not necessarily those of Assante Financial Management Ltd. This material is provided for general information and the opinions expressed and information provided herein are subject to change without notice. Every effort has been made to compile this material from reliable sources however no warranty can be made as to its accuracy or completeness. Before acting on the information presented, please seek professional financial advice based on your personal circumstances.