Blog

DO MARKETS PREFER A DEMOCRAT OR REPUBLICAN?

- by Adil Mohammed, CFP®, CIM®, FCSI®

- August 7, 2024

HOW WILL THE US PRESIDENTIAL ELECTION AFFECT MARKETS?

Above are the questions I am getting a lot lately. Here’s my answer:

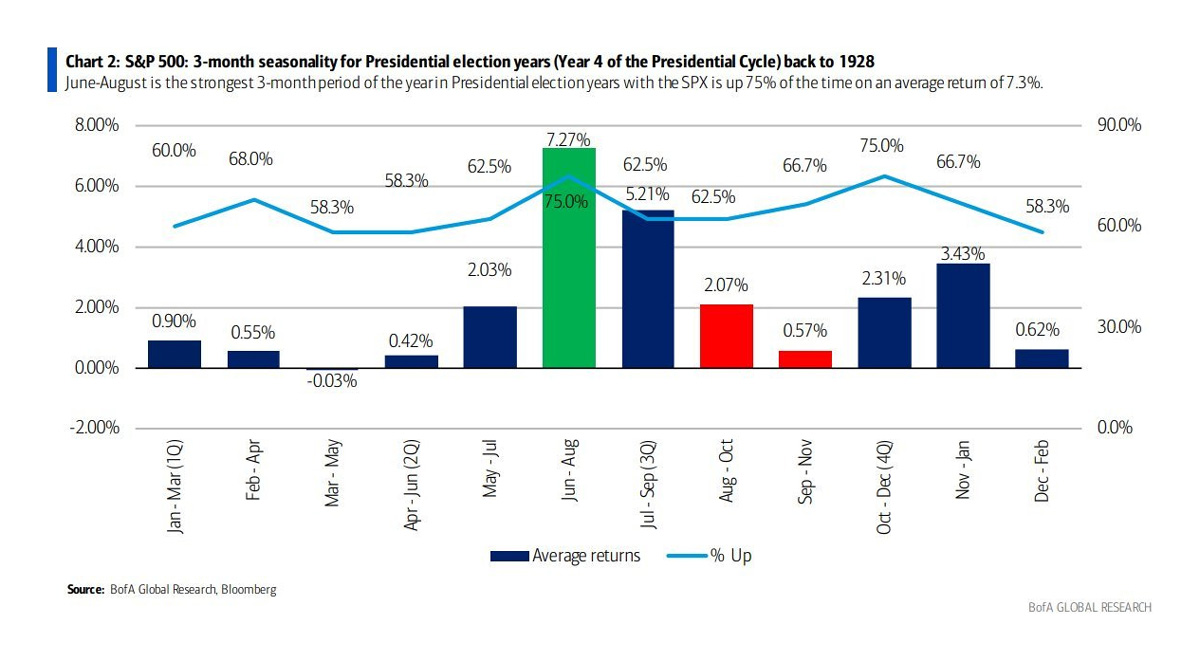

The general playbook in the fourth year of a presidential cycle is consolidation during the first half of the year. This basically means a range-bound or sideways market, before accelerating into the back half of the year.

Already you could argue that we aren’t following that pattern, as the first half of the year has been strong. Historically, the annual US market return is 7.5%, with a maximum drawdown of 15% in the 4th year of a presidential cycle. Nothing special here, as this is in line with long term averages.

June through August of election years tend to quite strong, while September to November tend to be weaker, given the uncertainty leading up the election, before accelerating into year-end once we know who is in the Oval Office.

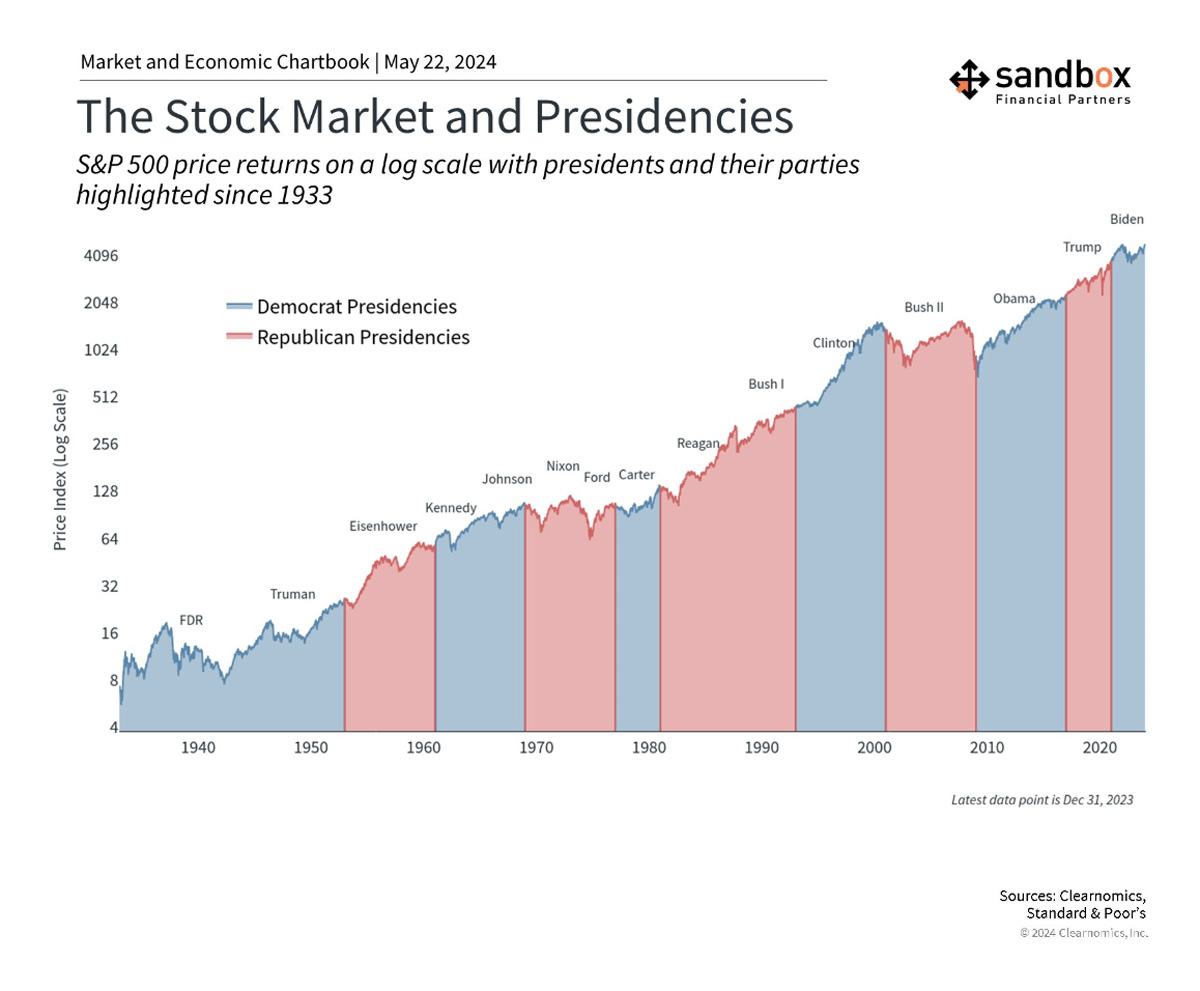

So, do markets prefer a Democrat or a Republican? Whether the Democrats or Republicans are in office, the markets and economy have historically performed well, so the fact is this: there is no major advantage either way. In the short term, you should expect election headlines to cause market volatility, but in the long term, the fundamentals of each individual business is what matters.

As you can see, regardless of the party, stock market returns are up and to the right. I’ll stop short of calling the November 2024 election a non-event, as the policies of the winner will affect many parts of economy. But from a market perspective, over the long term, it doesn’t matter.

So for now, just sit back and enjoy the political theatre – if you can.

By Adil Mohammed, CFP®, CIM®, FCSI®

Wealth Advisor

Assante Financial Management Ltd.

The opinions expressed are those of the author and not necessarily those of Assante Financial Management Ltd. This material is provided for general information and the opinions expressed and information provided herein are subject to change without notice. Every effort has been made to compile this material from reliable sources however no warranty can be made as to its accuracy or completeness. Before acting on the information presented, please seek professional financial advice based on your personal circumstances.