The Surroundup, Videos

GREAT COACHING MAKES THE UNCERTAIN MORE CERTAIN OVER TIME

- by Gillian Stovel Rivers, MA, CFP®, CEA

- August 28, 2023

“Trust always affects two outcomes: speed and cost. When trust goes down, speed goes down and cost goes up. When trust goes up, speed goes up and cost goes down.”

These are the words of the Stephen M.R. Covey from his book The Speed of Trust, and when I first began to conceive of this Surroundup in late July early August, I happened to be rereading it, and a few other interesting things happened all in the same few days.

First, I had a great little conversation with a new client of Surround about the difference between performance and results, more on that down below.

Secondly, my August 12th edition of the New York Times morning DealBook from Andrew Ross Sorkin covered two stories from the day prior. The first story was about the sentencing and lock up of Sam Bankman-Fried, founder of the collapsed cryptocurrency company FTX, and the other was about the latest trend in yachts being submersibles, which discussed the tragedy of Titan in the same paragraph as that of the Titanic, stating that nowadays owning a personal submersible represents the same status as having your own helicopter and helipad did in the 80s. (Wow, sign me up!?!)

Don’t get me wrong: I actually fantasize about having my own underwater home. I always have, it’s like a childhood meme for me. But the pursuit of that result, or the pursuit of exclusively crypto based wealth, is about as far from my mind as it could possibly be, for one very succinct reason: trust. These are just two prime examples where my trust in either version of reality went down, and as a result my speed of adoption went down, and my perception of what it will cost to ever get there, went up.

Then I ask myself: if I’ve lost faith in my illusions of these things being true examples of the way to wealth, where has that faith landed? Matter is neither created nor destroyed so that belief must have rooted itself elsewhere.

The answer I have for you is performance. Now my use of the word performance for a lot of people might easily be mistaken as meaning results, because interestingly, our industry seems to use them interchangeably. But Performance is itself, an action, a verb. It’s something we can DO.

Naturally this means if there is anything you can work to control, it’s probably Performance. For example, we can ensure we have tested the submersible below certain depths for stability before we put billionaires and their families onboard, and we can have and abide by certain liquidity requirements before allowing hundreds of thousands of investors to pile in.

Results on the other hand, are a noun, they are an outcome that happens because of a confluence of factors many of which are beyond our control. They are not something we can DO, rather they are something that will happen on their own. For example, atmospheric pressure below a certain depth in the ocean, or a sudden large volume of withdrawals without sufficient liquidity to support them.

This leads us to two questions for the balance of this month’s Surroundup, both of which we sought some answers to from leading quantitative and qualitative client experience expert Julie Littlechild, a colleague and friend of mine who founded world renown research firm called Absolute Engagement.

The first question is: what are the results I should be measuring for in my relationship with my advisor as examples that can be tied to performance habits and skills we can control together?

The second question is: which performance habits and skills can I work on every day and therefore exert some control over if I want to, to become the best ‘wealth athlete’ I can?

To recommend answers to these questions, I consulted several of Littlechild’s recent research papers, including Beyond Satisfaction: Why Client Engagement is the New Standard and 2022 Client Research” The Evolution Continues. Global Uncertainty and Demographic Shifts Are Changing Client Experience. Littlechild’s surveys traditionally leverage input from 1,000 high net-worth investors within a two-month span.

In The Evolution Continues, research uncovered that client relationships are strong, but loyalty is less strong. Demographic shifts and online tools are changing how clients find advisors, and how advisors need to present themselves in the face of these new self-serve tools.

In Beyond Satisfaction, it becomes clear that the answer to the loyalty factor – to the gold standard of trust – lies in the gaps in the client experience between Engaged and Not Engaged clients, as seen here:

Returning to the original premise of this blog, where trust is a function of performance that yields results, it’s important to know at Surround that these are the performance metrics we build our business around. As such, it’s just as important whether you are a client of Surround or another firm, to ask yourself these questions, because they are not only going to drive performance, but they are also going to drive your results over any time horizon.

- Do you have a strong personal relationship with your advisor?

- Does your advisor provide support that goes beyond money and investments?

- Does your advisor understand your life goals?

- Does your advisor regularly review your objectives and understand if or how they have changed?

- Does your advisor actively seek to understand how you are feeling beyond your plan or portfolio?

- Does your advisor proactively ask how the uncertainties of the last few years have impacted you?

- Do you AND your spouse feel completely engaged in meetings with your advisor?

If you find yourself answering like an Engaged client, there is no need to ask Dr. Google for help with your finances, because the work that can be achieved when the focus is on you and your financial questions and goals, it’s airtight and ready for anything. That’s how we measure performance.

We all know how important speed and cost are in our world of today. I hope you have enjoyed this short survey of the timeless of topic of trust as it relates to financial decision making, and further appreciate how we at Surround intentionally go about investing in our relationships with clients to build the currency of trust over time.

This is a 50-year plus game, friends of Surround. At Surround we focus first on what we can control, and that means we focus on our collective performance for building wealth. Performance is the hard stuff but it’s also the good stuff, because if you really want to do it, you absolutely will not fail.

It’s grunt work: budgeting, saving, having regular money conversations with partners, children and loved ones, treating business decisions like business decisions, and making sure the people on the team are the best fit for the journey of performing what it means to build wealth.

Make no mistake, we absolutely test the value of our performance by evaluating results regularly, just as an athlete does in competition, but since the part of wealth building related to investing includes global organic circumstances beyond our control, it’s at those times that the focus on strength, resolve, focus, and self-care both mental and physical, are incredibly important parts of the job of building wealth.

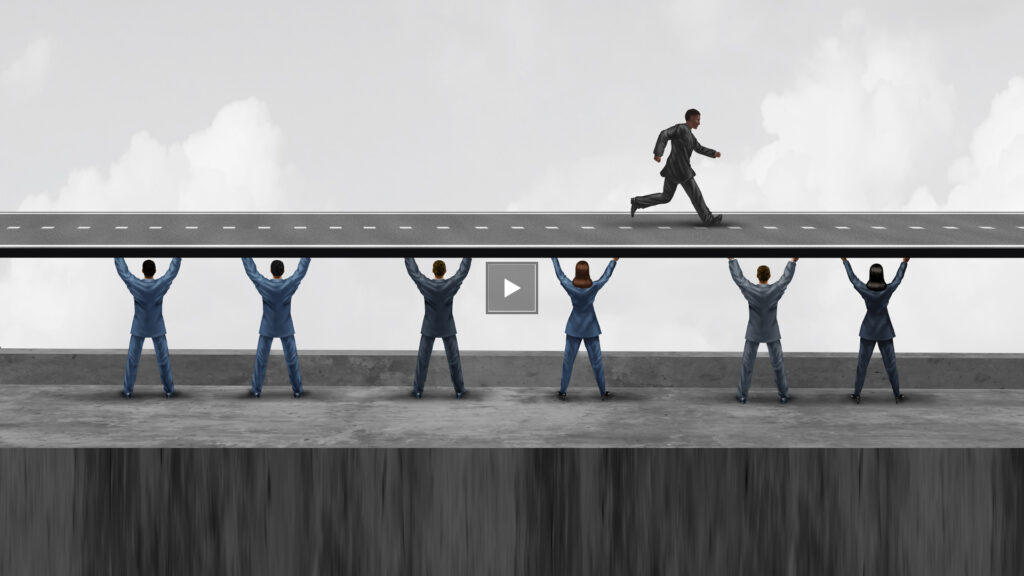

We can achieve results and bridge the gap between the certainty of performance and the uncertainty of outcomes, by working earnestly on all the skills related to the game. It takes time, focus and skills, but the results are priceless. And as these skills bring your performance closer to your desired results, that’s where trust lives for us all.

Until next time, remember at Surround, we are not just thinking about the next day, we are thinking about the next level, and as always, there’s more than one way to wealth.

Gillian Stovel Rivers, MA, CFP®, CEA

Senior Wealth Advisor

Assante Financial Management Ltd.