The Surroundup

HERE’S WHAT WE WANT YOU TO FOCUS ON

- by Andrew Hawryluk

- December 21, 2021

It is that time of year. For the holidays, yes, and all the good things that come with them.

It is also a time for reflection, on what we accomplished this year as human beings, what we still have to do – and what our focus should be on in the next trip around the Sun.

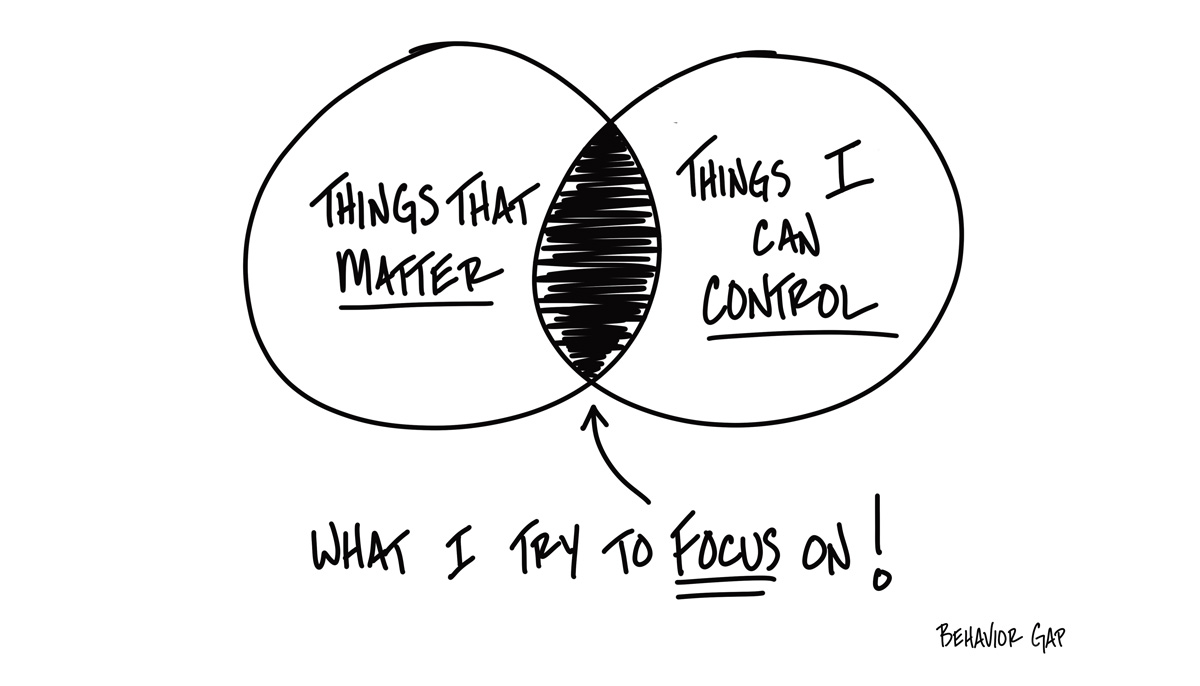

Please see the graphic that accompanies this edition of The Surroundup. Its creator is a financial planner by the name of Carl Richards, otherwise known as “The Sketch Guy.” Here, Carl is suggesting that when we are considering what to focus on, let it be the things we can actually control.

I was speaking with someone recently who was irritated by all the leaf blowers that were out there this fall, creating so much noise. What a great analogy for our lives overall: there is so much noise, and we can actually control but a very small part of it. There are leaf blowers everywhere in our lives.

As an example, Inflation has been a hot topic in 2021. Throughout the year, and in the year-end reviews just completed, we spoke about it quite a bit with our clients. Unfortunately, the price of bananas is not something that a client, or we, can control. What does Carl’s sketch suggest we do? Here is Surround’s interpretation: it says trust the people you have hired – us – and the managers we utilize, to manage your portfolio in such a way that minimizes the effects of inflation. You are paying someone – us – to worry about it, so you don’t have to. Go and enjoy some eggnog instead!

Have another look at the sketch. Can you see how very small the area of overlap is between the two circles? That’s right: compared to everything going on in the world, the humbling truth is that we can control very little. And yet this truth, if we are willing to accept it, is actually liberating. How much control do we have over the news as delivered to us by CNN, Fox or any other network? Exceedingly little, and yet so many of us allow the media to take us for an emotional rollercoaster ride every 24-hour news cycle.

I am very proud to say that our clients are far from worrywarts anyway. They have learned, from working with us, that the markets are bound to ebb and flow. And that as humans, our emotions are prone to ebb and flow too. All of this is completely normal, and there is no need to worry, much less panic. What came through most clearly in our year-end reviews is that among our clients, overall sentiment is high. They are cautiously optimistic, and we are as well.

But of course, they had questions, as they should. In a nutshell, clients want simply to know if their portfolio is doing well. This year, many portfolios did unusually well, and we recognize that these returns are not sustainable over the long term – which we have more control over in the context of your portfolio, because the longer the time span, the more predictable the outcome.

Related, clients want to know if they are well diversified. Our answer is yes. We continue to stress that having a well-diversified portfolio is the key to a consistent rate of return, as opposed to chasing stocks that are “hot” right now. Well-diversified, well-balanced portfolios: it has been proven, time and time again, that they win the race.

That said, your portfolio does not a wealth plan make. A great analogy we heard many years ago and continue to reinforce to this day is that your investment portfolio is the engine of the car – however, as we all know, the engine is just one component of a complete automobile. The wealth plan is that complete automobile, and you need all components – the engine, transmission, interior etc. – to make it complete. It’s great to have a great engine, but without the wealth plan to house it in, you’re not going very far.

The wealth plan is where you have things that, unlike the markets, you truly can control. Like your estate plan, including your wills, powers-of-attorney and beneficiary designations. It is absolutely crucial to have these complete. A winning portfolio will not be of much comfort to your heirs if an incomplete or non-existent estate plan ends up causing them anguish in addition to what they will feel over your passing.

What can you control in 2022? What do you want to focus on? Just let us know. Because – you guessed it – we’ve got this surrounded.

In the meantime, from all of us here at Surround, we hope you focus on having a very Happy Holiday and New Year!

P.S. Have you seen our holiday video? We are thrilled at all the positive feedback it is receiving. Here it is: Family Giving At Its Finest.