The Surroundup

HOW DO YOU INVEST IF YOU LIVE A LONG, LONG TIME?

- by Gillian Stovel Rivers, MA, CFP®, CEA

- September 23, 2021

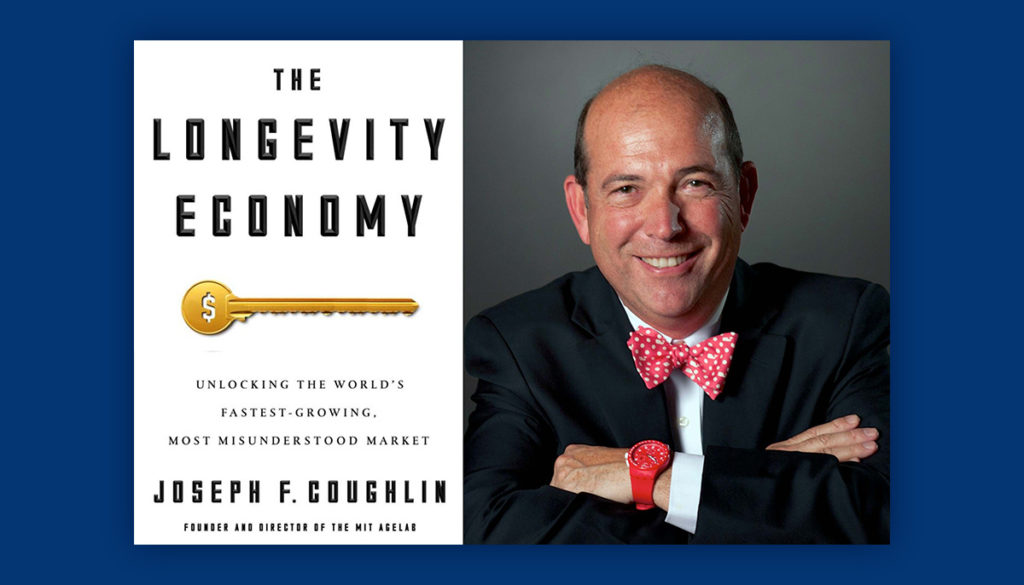

Just prior to the pandemic, CI Financial CEO Kurt MacAlpine announced a long-term partnership with MIT professor Joseph Coughlin: a researcher of demographic change, founder of MIT Agelab and author of The Longevity Economy: Inside the World’s Fastest Growing, Most Misunderstood Market.

As Kurt put it, “Joe Coughlin’s work is directly relevant to a critical issue facing older Canadians today — transitioning from accumulating assets to turning those assets [into] a source of retirement income that will last 25 to 30 years or more.”

Since the introduction of this partnership was swiftly forgotten with the onset of the COVID-19 pandemic just a few weeks later, this month we’re throwing some light back onto this topic, for these reasons:

1) What we do equals what we get.

It’s right there in element #5 of our Manifesto: Wealth does not happen by chance. So we are not just staying on top of things, we are staying ahead of things, as we must – to help you be wealthy in every way important to you now and in the future.

2) To remind us all that accumulating wealth and decumulating wealth are two different things.

In simple investment account terms, accumulating requires we develop certain parts of our brain and habits such as discipline, focus, sticking to a plan, putting things in one basket so they can grow efficiently. And working with a trusted and savvy wealth advisor to develop both the habits and choose the right investment vehicles.

Using your wealth is a whole other ballgame, and using it well puts the workload on knowing oneself, learning to enjoy, embracing the idea that time and relationships are important areas in which to invest, and living within a budget while still living well.

Working with a trusted and agile wealth advisor is just as critical here; this phase of wealth management calls for an advisor who is attuned to your unique needs and values as they relate to how you want to use your time in retirement, as well as the importance of your legacy. They are driven to help you maintain good habits and once again find yourself in the right investment vehicles.

3) To introduce the CI Global Longevity Economy Fund, and a new breed of funds like it,

which incorporate insights from Dr. Coughlin’s book to help identify the companies with the potential to serve the new and changing needs of this growing group of long-living wealthy consumers.

The fund is managed by Jeff Elliott, Ph.D., whom many of you will recall from one of our first webcasts about the economic impact of the virus in early 2020. The fund seeks to identify the companies with the potential to serve the new and changing needs of this cohort, and focuses on 40-60 reasonably-valued firms with the potential to outperform the market over the next 5-10 years.

You might be interested in learning more about this fund, or simply take comfort in the knowledge that we integrated funds like it – such as the CI Munro Global Growth pool, Signature Global Technology (now called CI Global Alpha Innovators) – into our clients’ portfolios, in 2020 and 2021, when deemed appropriate.

4) And finally, we are sharing this topic with you today to invite you to ask us for your own copy of Coughlin’s Longevity Economy.

Let us know if you would like to read it, and we’ll connect with you to find out how – in hard copy, or perhaps as an audio book, so you can take this topic for a walk a few times, and build your own longevity in the process.