Blog

Key Takeaways from 2018: Remain Engineered for the Long Term

- by Adil Mohammed, CFP®, CIM®, FCSI®

- December 21, 2018

Following a relatively stress-free investment environment in 2017 with low volatility and strong returns, 2018 has been a much different story. Markets have yet to bring any holiday cheer as the last few weeks have been particularly turbulent for stocks.

I’m writing to offer some critical perspective about the latest market developments and to reassure you about the rigorous process, strategy and substantial experience with which your portfolio and financial life is managed.

Let’s start by answering 3 questions:

- Is it just me?

- Should we get out?

- Is this normal?

Is it just me?

Ned Davis Research divided markets into eight major asset classes – from bonds to U.S. and international stocks, to commodities – and concluded that not a single asset class has generated any meaningful returns in 2018.

Let’s see how markets around the world are doing:

As you can see, it’s not just you, markets around the world are struggling with no place to hide.

To us this is a reminder of just how much revaluation has already occurred with very little damage done to your portfolios because of the rotational discipline and current defensive mandates across our asset classes.

Should we get out?

We all know that trying to time the market requires that you be right twice. Once on the way out, which may seem easy, but again on the way back in. History has shown that trying to time the market or leaving the market as a result of an emotional decision is detrimental to your long term rate of return and in many cases results in permanent loss of capital.

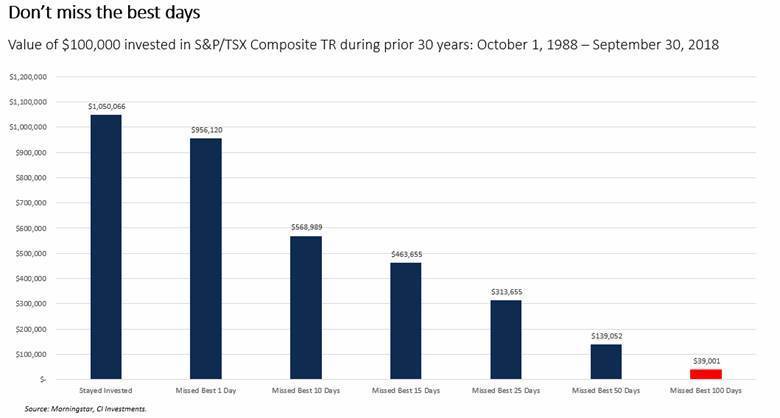

Here’s one illustrative example of the financial benefits of staying invested over time despite temporary market sell-offs. The chart below shows the hypothetical impact on a $100,000 investment of pulling out of the market over a period of time and by doing so, inadvertently missing out on some of the highest or best trading days (ranging from 1 day to 100 days). A key lesson: it’s impossible to time the market perfectly, so stay invested to capture the inevitable upside.

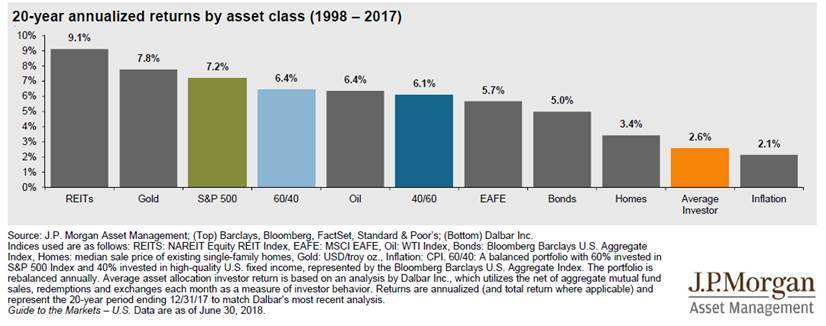

Another example is the chart below which highlights how poor investment behavior leads the average investor to underperform all major asset classes over 20 years. This underperformance is as a result of emotional decisions trying to time the market rather than focusing on the long term plan. The message is clear: investors trying to time the market leads to sub-optimal returns.

Is this normal?

Yes, volatility is normal and part of plan when building an investment strategy.

An important point to understand about any market decline is that it creates potential opportunities to buy additional quality growth companies at attractive prices. Referring, for example, to the more than 10% drop in the technology-laden Nasdaq Composite Index in October, one business reporter offered up this perspective: “If the price of milk or a car or an Apple iPad dropped 10 percent, would you sneer? Or would you run out and buy it?” (Source: The Washington Post: “How I learned to love a good downturn in the stock market.” By Thomas Heath, October 26, 2018). CI Multi-Asset Management, which oversees the investment portfolios, continues to rigorously monitor the markets and identify suitable opportunities when they arise. The team has the skill and conviction to take strategic risks when there is a higher probability that this will lead to outsized returns.

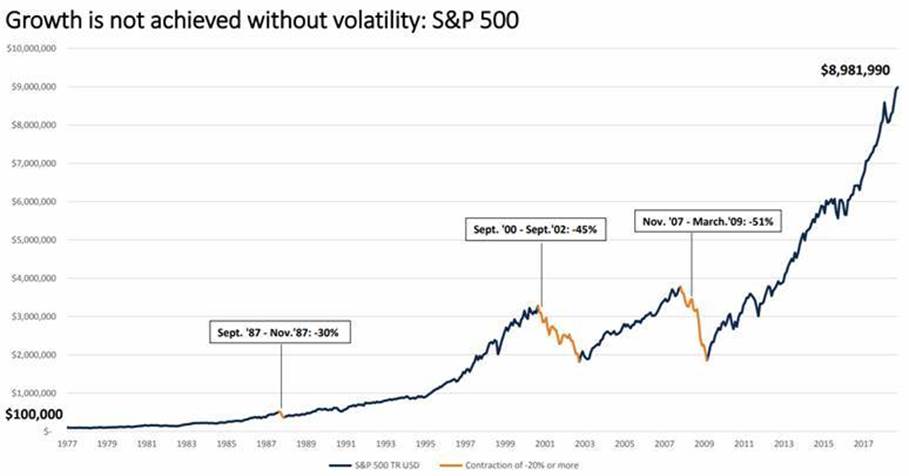

Market corrections are a normal part of the stock-market cycle and will occur sporadically. But these drawbacks are temporary – stocks have historically always bounced back. Moreover, the downward volatility in today’s stock prices will have very little impact, in the long-term, on the ultimate value of the many quality companies held within your portfolio.

Remember, there is no growth without volatility:

So what does this mean?

It means years like 2018 are planned for and are needed to lower valuations, so we can again purchase companies at bargain prices. Below is an example of why it matter what price you pay for a company.

In the case of Cisco, consider the wide divergence in investment returns based on the stock’s valuation at different times. If purchased at its highest price of $80.06 on March 27, 2000 an investor’s total return would have been -25.05%. In contrast, buying the stock at the bargain price of $8.60 on October 8, 2002 would have generated a total return of 597.80%. The lesson: valuations matter.

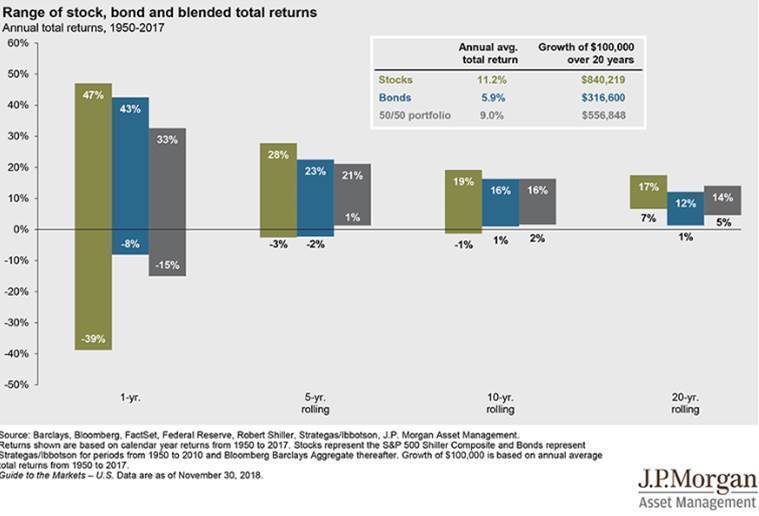

We must understand that in the short term, anything can happen but over the long term, outcomes become much more predictable. Take a look at the below, since 1950, over a one year time horizon, the range of outcomes can be substantial and quite unpredictable. But over time, the rate of return of a portfolio becomes much more predictable. Therefore a 6% rate of return, for example over the long term is very achievable with the right strategy even if we include the 1 year swings.

Conclusion

We’ve have experienced 7-8 years of strong markets and we are now facing a rising interest rate environment, fears that global growth is slowing, trade tensions and geopolitical uncertainty.

Our focus continues to be on capital preservation, risk management and defensive positioning. There are certain times when it’s more important to minimize losses than to reach for gains. This is one of those times.

Let’s remind ourselves of what we are trying to accomplish…

We are trying to achieve a rate of return that is required by the financial plan over an entire market cycle without taking on any excess risk. To achieve this, we have implemented a disciplined, adaptable and repeatable investment process with a proven track record.

A year of volatility shouldn’t suddenly derail that process.

I was listening to a podcast a few days ago, and I was reminded of the 4 scariest words in investing – This time it’s different (TTID).

We must be careful we don’t fall into that trap. This is not new, it has happened in the past and it will happen again.

Remember it’s not just you and it’s part of the plan.

On behalf of Gillian, Andrew myself and your whole team at Assante, rest easy and have a very safe and happy holiday season.

See you soon in the new year.

Adil Mohammed, CFP®, CIM®, FCSI®

Wealth Advisor

Assante Financial Management Ltd.