Blog

Market Corrections: Part of the Plan

- by Adil Mohammed, CFP®, CIM®, FCSI®

- February 28, 2020

On December 21, 2018 I sent out an e-mail that began with “Following a relatively stress-free investment environment in 2017 with low volatility, 2018 has been a much different story”.

Just over one year later, I could essentially repeat that sentence (updating the years of course) and it would basically tell the current story.

Following a relatively stress-free 2019 with low volatility, the past week has been a much different story.

I’m here again to offer some critical perspective and remind you that market corrections are normal, necessary and part of the plan!

I also want to remind you that you’ve only recently gone through a similar experience, in the last few month of 2018 and you were rewarded in 2019 for sticking to the philosophy, process and strategy.

What is happening with the markets?

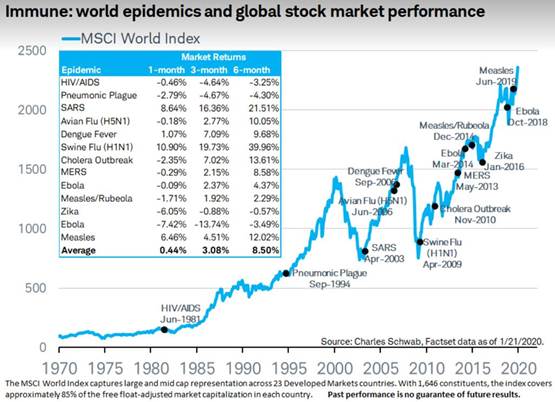

The spread of the novel coronavirus is having an impact on global transportation and trade, which is slowing the economy. This is reflected in declining stock markets. We’ve seen these kinds of dips in the past with disease outbreaks like SARS and H1N1.

Some perspective:

Every year there is macro event that causes volatility and this year is no different.

Other Epidemics:

On average markets are up 8.50% 6 months after the epidemic.

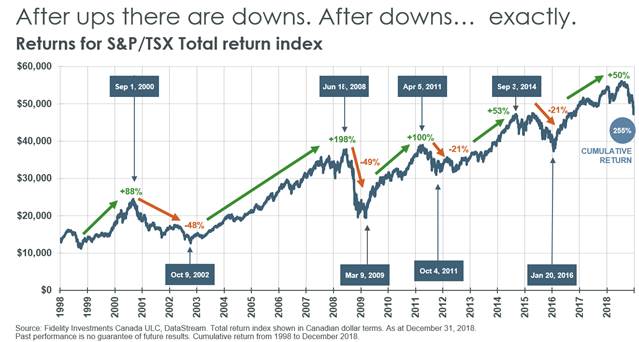

Markets continue to trend higher:

What steps are we taking to manage risk inside the portfolios:

- At the onset of the virus (before the big drop), we reduced equity across all income and balanced portfolios by 3-4%, primarily from international and emerging market equities.

- This includes our exposure to Chinese markets, which remains low

- Government bonds, gold bullions and foreign currencies have performed well and helped offsetting the volatility from the equity portion

- Remember the bond (income) portion of your portfolio historically increases in value, when markets lose value (protects you)

- We remain cautious on emerging markets and China.

- Our cash and gold positions range from 7 – 11%+ depending on the portfolio

- These two asset classes protect you in market sell offs

- The cash is then used to buy those same companies but at a lower price (buying opportunity)

What should you do?

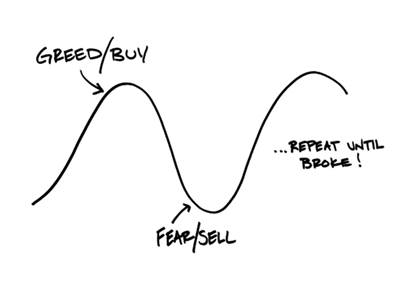

The worst decision we can make is an emotional one. We all remember the below picture:

You should ask yourself if your goals or financial objectives have changed as a result of the past week.

If not, I finish with the words from my December 21st 2018 e-mail which reminds us of what we are trying to accomplish.

Your portfolio’s objective is to achieve an expected rate of return as required by the financial plan over the necessary time horizon. Market corrections are built into the model and are necessary in order to accomplish your objective.

To achieve this, we have implemented a disciplined, adaptable and repeatable investment process with a proven track record.

A couple weeks of volatility shouldn’t suddenly derail that process.

I was listening to a podcast a few days ago, and I was reminded of the 4 scariest words in investing – This time it’s different (TTID).

We must be careful we don’t fall into that trap. This is not new, it has happened in the past and it will happen again.

Remember it’s not just you and it’s part of the plan.

Final Thoughts:

Exercise, eat healthy and take vitamins to boost your immune system. In terms of investments, let us allocate for you.

On behalf of Gillian, Andrew and myself, have a safe and enjoyable weekend.

Adil Mohammed, CFP®, CIM®, FCSI®

Wealth Advisor

Assante Financial Management Ltd.