Blog

PLANNING MATTERS: 2023 FIDELITY RETIREMENT REPORT

- by Adil Mohammed, CFP®, CIM®, FCSI®

- July 7, 2023

I recently read the annual Fidelity Retirement Report and wanted to share some of its insights.

This is a survey based report which began in 2005. It aims to understand the current retirement trends and strategies as well as provide insights into the attitudes and behaviour of Canadian pre-retirees and retirees. A significant part of our role as wealth advisors is to guide people through major life events and retirement is one of the biggest.

Growing up, retirement seems like such an easy concept. A seamless transition from emails, meetings and responsibility to beaches, golf courses and relaxation.

By working with many clients either in retirement or going through the process and more recently watching my parents creep closer to retirement, I’ve come to learn that it’s not so simple.

I get it.

The income tap is being turned off, questions of “do I have enough” and “what do I do next” are top of mind, leaving behind a fulfilling career spanning most of your life along with the uncertainty of the future. It’s a lot work through.

With that said, let’s see how Canadians are feeling towards retirement including some highlights from the report:

- Canadians remain optimistic about retirement (73%), however this has dropped from 80% in 2018 and down slightly from last year at 75%. This is largely due to the increasing cost of living and higher interest rates

- Retirement remains the most important savings priority for pre-retirees

- Cost of living is the main factor holding Canadians back from retiring

- As the cost of living continues to rise, 42% of Canadians have reported saving less compared to the previous year.

- Many Canadians in and approaching retirement are turning to safe investments (potentially reducing their retirement income over time). This is 10% higher than last year.

- Canadians with a written wealth plan have reported feeling considerably better prepared, both financially (91% vs 58%), emotionally (85% vs 69%), socially (84% vs 69%), and physically (88% vs 73%) compared to those without such a plan.

- Among those with a wealth plan, 82% collaborated with a financial advisor to create the plan. 64% of pre-retirees who have an advisor have peace of mind that their financial goals are on track, compared to 34% without an advisor.

- Despite the apparent benefits, only 28% of Canadians have a written plan

It’s no surprise that the biggest takeaway is the benefits of having a wealth plan. Gillian speaks to this in a recent Surroundup.

I spend a lot of time talking about markets and investing but it’s the plan that really matters. It’s what you can control, it’s where you can test scenarios, it’s where we can make adjustments and it’s what give you comfort that you’re still on track when the markets try to convince you otherwise.

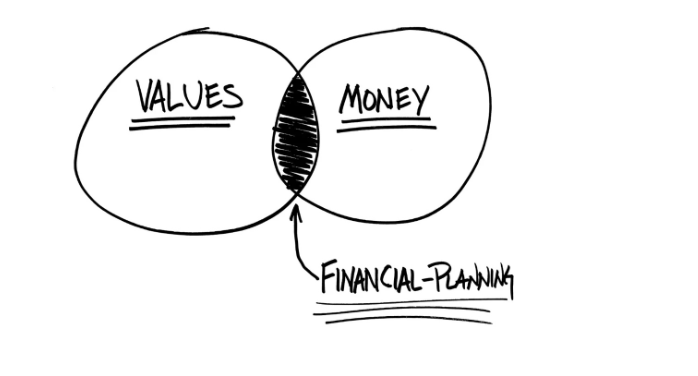

Remember money means nothing on it’s own. It’s merely a tool in the arsenal to help you achieve what’s important to you.

This is something we truly believe in and is one our core values – “money is not wealth”.

Carl Richards always says it best:

Bottom line, think about what matters most to you and lets make sure that’s incorporated in your plan, everything else is secondary.

If you’d like a full copy of the retirement report, let me know by email.