The Surroundup

REAL ESTATE OR STOCKS?

- by Adil Mohammed, CFP®, CIM®, FCSI®

- July 30, 2024

WHICH DO YOU THINK IS A BETTER LONG-TERM INVESTMENT – REAL ESTATE OR STOCKS?

If you said real estate, you would agree with the latest results from Gallup’s 2024 survey, in which Americans at all income levels perceive real estate as a better investment than other options.

In fact, real estate has been at the top of the charts for over a decade.

More recently, according to a Bank of America study, wealthy Americans aged 21-43 rated real estate investments as the greatest opportunity for growth – and US stocks as the worst.

So why is this? Why do people perceive real estate as the best long-term investment?

Is it based on numbers? Has the return on your real estate outperformed your return on your investments?

This is difficult to answer, as everyone’s experience will be unique. It depends when you bought your home, where you live, how much you paid and so on, and the same holds true for your investment strategy. Everyone’s different.

Proof that stocks have higher long-term returns than real estate

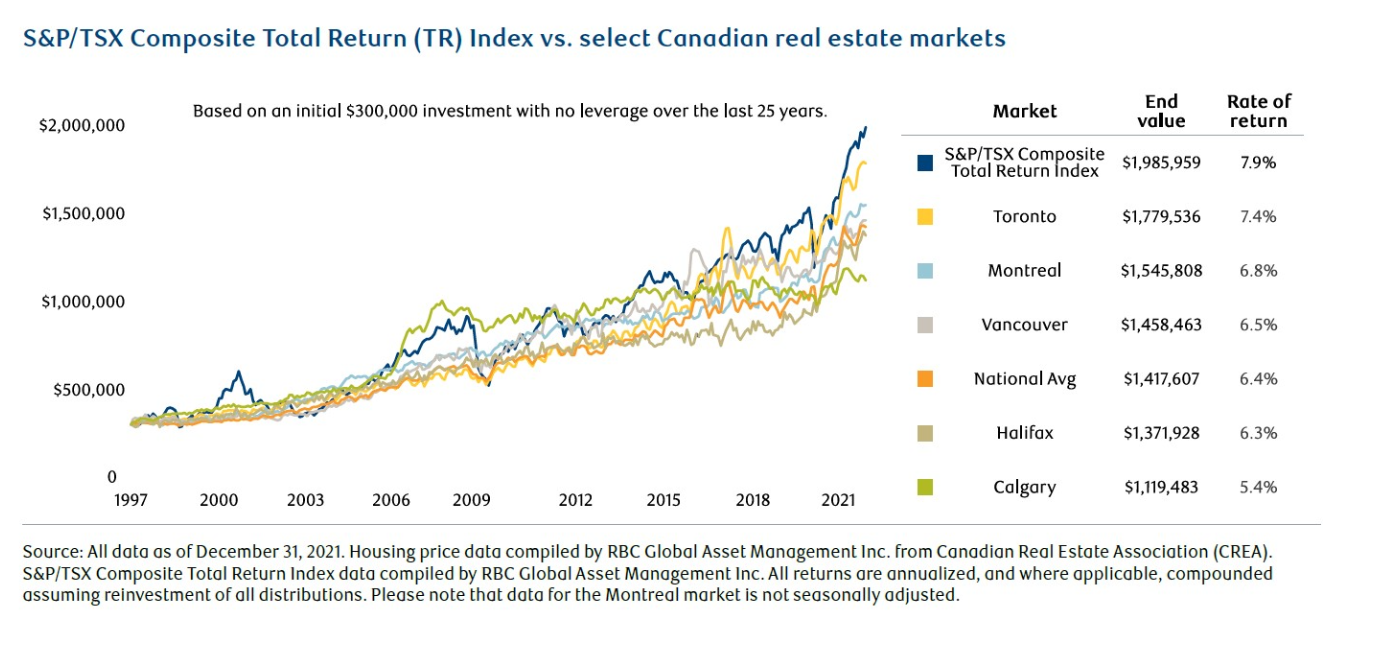

That said, RBC did compare the return of the Canadian stock market vs real estate in major Canadian cities from 1997 to 2021, and stocks outpace real estate in the hottest cities – Toronto, Montreal and Vancouver. And they outpace the national average.

If we look at the US, the same holds true. US stocks have higher returns over time vs real estate.

I suspect that the reason people perceive real estate as the best long-term investment has less to do with the actual returns and more to do with the psychology behind holding real estate.

Five reasons people think real estate outperforms stocks

- For one, real estate is a tangible asset that you can touch, something real that you own and you feel in control of. It gives off a sense of stability. Although owing shares of say, Apple or Walmart is very real, it can feel like owning fairy dust at times. There is nothing tangible, only a computer screen showing you what you own and its value. And because it’s just number on a screen, it feels like it could go to zero, or to infinite.

- Second, your house or cottage is not publicly traded. And because it’s not publicly traded, it feels less volatile, making it seem like a safer investment. In real estate, you don’t feel the gut-wrenching up and down days, and thus it feels like a calmer experience.

- Next, most people look at real estate as a long duration asset (20-30+ years), meaning they don’t expect much in the short term. And even though that should be the same mentality for stocks, because of stocks’ daily liquidity, people take a much more short-term, opportunistic approach.

- Fourth, in real estate, most people anchor to their purchase price. You always hear, “I bought this house in 2006 for $200,000 and I’m selling it today for $700,000.” You almost never hear, “I invested $200,000 in the market in 2006 and now it’s $700,000.” When investing, given its public nature, people anchor to yesterday’s value or last month or January 1st, creating a much more uncomfortable experience.

- And lastly, housing prices, particularly in Canada, have simply skyrocketed since the pandemic (see graph below) – but that trend has been in place for some time. So there’s going to be some recency bias. Understandably, this has led people to believe that with real estate, they can earn a meaningful return while feeling stable, safe, and less volatile.

Source: The U.S. Federal Reserve Bank of Dallas, The Economist

Pros and cons of real estate vs. stocks

Ultimately, it’s not about one being better than the other. Both real estate and stocks have their pros and cons. What’s important is that you’re diversified. A client who has all their wealth tied up in real estate is likely facing concentration risk and potential illiquidity issues. Whereas someone who holds only stocks is subject to the gyrations of the market. What you want is multiple asset classes, a combination of real assets and intangible assets, moving in different directions, uncorrelated, ultimately reducing your risk and increasing your financial flexibility.

That’s it for this edition of the Surroundup. And always remember, There’s more than one way to wealth®.

By Adil Mohammed, CFP®, CIM®, FCSI®

Wealth Advisor

Assante Financial Management Ltd.

The opinions expressed are those of the author and not necessarily those of Assante Financial Management Ltd. This material is provided for general information and the opinions expressed and information provided herein are subject to change without notice. Every effort has been made to compile this material from reliable sources however no warranty can be made as to its accuracy or completeness. Before acting on the information presented, please seek professional financial advice based on your personal circumstances.