The Surroundup, Videos

SURROUND’S WORLD CLASS WEALTH ATHLETES FOLLOW 3 SIMPLE RULES

- by Gillian Stovel Rivers, MA, CFP®, CEA

- February 27, 2023

Being a CrossFit Coach is both an honour and a duty — and the great ones live by one charter: “My competency is solely defined by my efficacy.”

Being a Wealth Coach is both an honour and a duty — and if you ask me, the great ones also live by this charter: “My competency is defined by my efficacy.”

One of the things I love about having a life motif as powerful as CrossFit is how much it infiltrates and informs the way I handle all the other aspects of life.

I mean let’s face it: if you are in the hunt for anything at an elite level where you physically have to adapt to be able to achieve it, your good days are huge, and your tough days are pretty brutal. But there are also many, many hours and days of simply putting in the work.

I was coached by CrossFit New England’s Ben Bergeron back in 2019, and one of his mantras was “50% practice, 40% training, 10% competing”. We don’t actually compete every day unless we are aiming for burnout, and the same is true about building wealth.

Real wealth building is actually pretty boring. It’s a series of sound decisions, made with conviction, carried out consistently with varying intensity, over a long period of time. “Legacy is what gets built when nobody is watching” is a sign I saw during a broadcast of the Raptors game last night. And it’s so true. So the fact of the matter is, there is an Assante advisor for everyone, but when you work with me, this is what you get. “My competency is defined by my efficacy” helping our clients using this methodology.

How does this impact the way I contribute to how Surround does business? How does it not, I ask you. Our clients have goals, some they know about and some we help them define by asking interesting questions – questions like what does money mean to you? How would you like money to impact the things you care about? When you’re no longer of this earth what would you like your wealth do have accomplished? And like athletes, our clients have many options when it comes to the “programs” they could follow and the habits they could embrace in order to create, maintain and grow wealth.

As a coach, I aim to see first where patterns are strong, and also where patterns are less strong. Then we begin the delicate but efficient process of getting to work. It is a thing of beauty when someone trusts a coach enough to follow the methodology, walk out and then witness the desired results over time, and understand there are two roles here for a reason. The coach coaches, the athlete executes.

If you ask me, you are all athletes of Surround. Wealth athletes. If you are in the hunt for something at an elite level – which you are because that’s why you are working with Surround – it can be helpful to adopt the same kind of strategic mentality that exists between coaches and athletes. Just as I talked through the CrossFit charter last year – Mechanics, Consistency, Intensity – today I am going to lay out three timeless wealth athlete lessons we can reflect on as we move from a time of stress – ie 2022 – to a time of once again growing prosperity.

1. THE PLAN IS ALWAYS THE BOSS (AND YOU ARE THE BOSS OF THE PLAN)

This is rule number one for a reason, because it’s truly the Rosetta Stone for building wealth. What is the money for, where is it coming from, where does it have to go, and how do we need it to behave so these things can all happen?

The Surround Wealth Plan is not only mechanically essential so that we can implement points 2 and 3 below, but as an athlete you need to know the object of your game, who the players are and what the definition of winning is going to look like. And it’s completely unique to every person. It also morphs and adapts as you and your life goals change, and so long as we have a database and a shared language to put it up on screen and connect the security of those numbers with the certainty of your feelings, over time, this is how we win.

No matter how many bear markets or corrections or even raging bull markets I go through, I know “this too shall pass.” So long as we begin every meeting with our North Star – what the money is for, where it comes and goes, and how we need it to behave – we always win. In updating client wealth plans before the 2008 financial crisis, during the financial crisis, after the financial crisis… before COVID, during COVID, in the bull rally out of COVID, as 2022 occurred and now again as we recover out of that, I sleep just fine at night because the wealth plans of Surround’s wealth athletes remain either on track or ahead of schedule. The coaches coach, the athletes execute. But the start and end of it all is always THE PLAN.

2. RIGHT TOOL FOR THE JOB

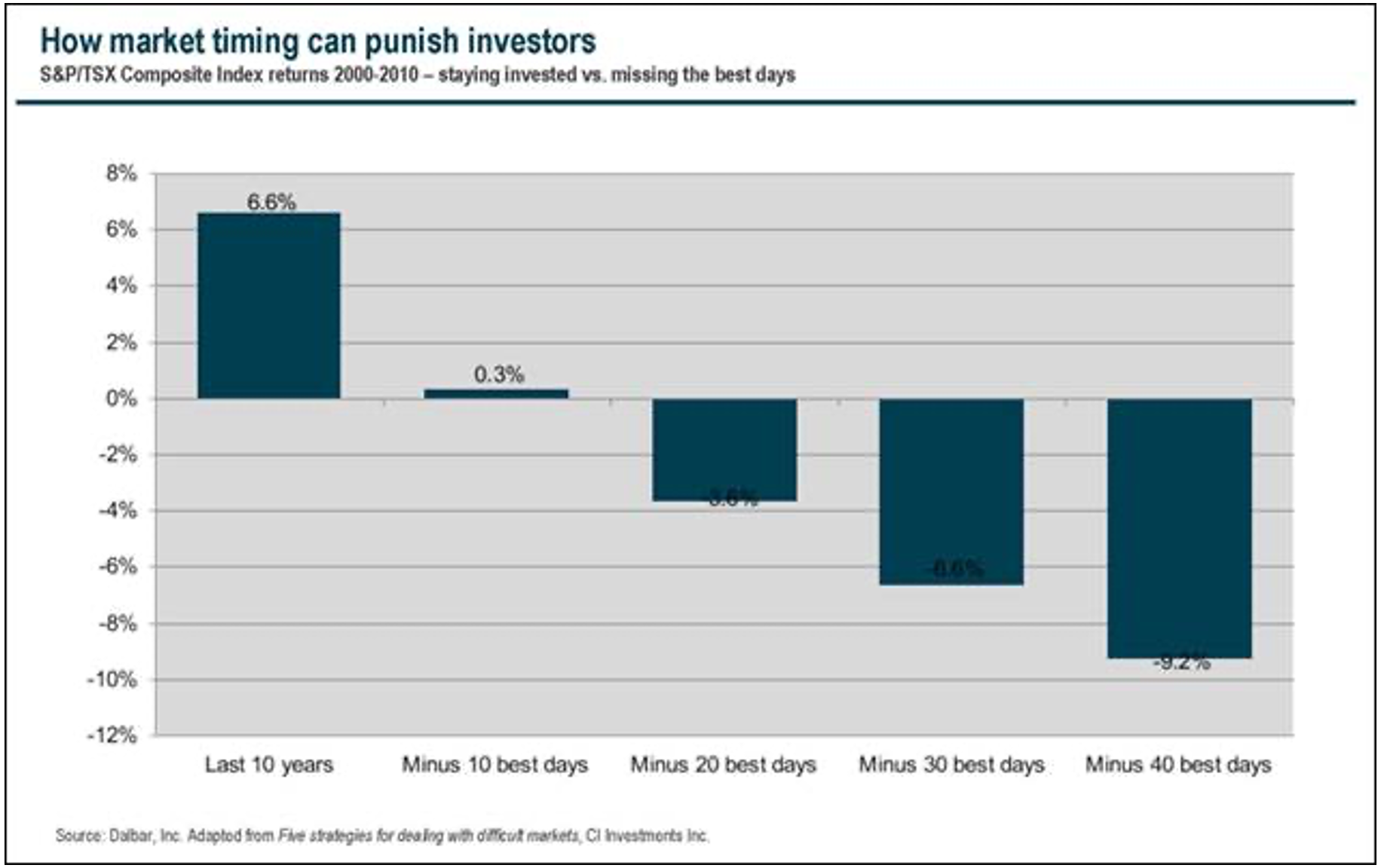

We don’t time the markets. It is not easy to understand this concept until you get it wrong, and then you know there must be another way. And that other way is super duper boring compared to the “thrill” of trying to time the markets. Not only do you have to be right about what to get into when, you have to be right a second time about what to get out of when. The next time you think “oooh, market timing!”, please immediately replace that thought with “right tool for the job.”

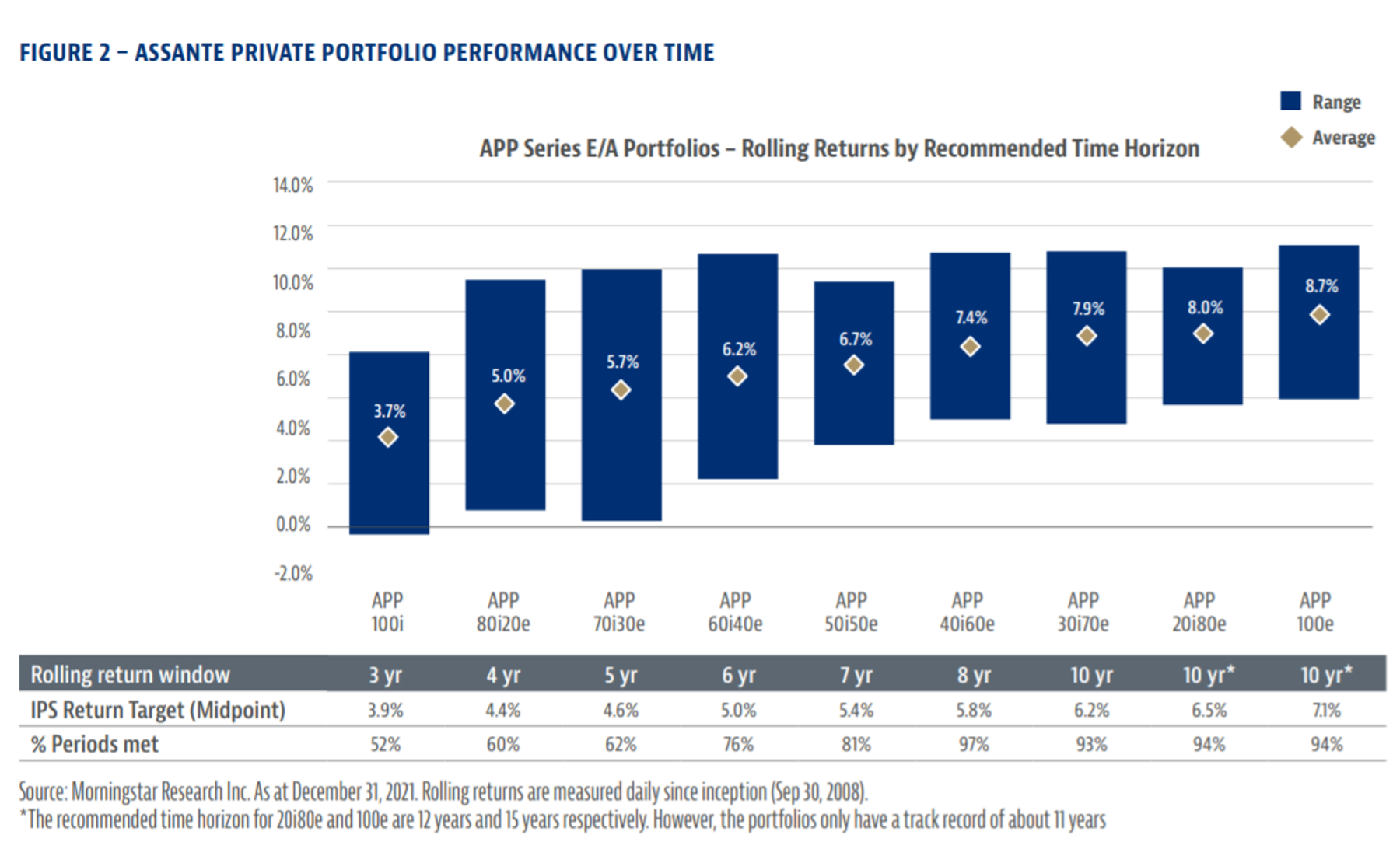

For money you need inside 12 months, high interest savings account, which by the way now pays you handsomely for the moment. Money you need between 1-3 years, we allocate to something aimed at 100% income, or the “100i” portfolio as an example in the graphic. Money for 3+ years from now, diversified portfolio of between 20% equities up to 50% equities. 5+ years, more equities. 10+ years, 80-100% equities. This is an essential piece of wealth building mechanics to embrace, against which we lay the athletes investing personality to determine any nuances to aggressiveness or conservatism.

3. BEAR MARKETS ARE AN ESSENTIAL ORGANIC ELEMENT IN A NEVER-ENDING CYCLE

As Adil mentioned in his market recap piece last month, 2022 was epic. Not necessarily in the way you might have wanted it to be, but secular adjustments like that come along once in a generation. But athletes: we have done it! We survived the interest rate hike cycle, which had a challenging impact on stocks and also on bonds. I have literally dreaded-slash-eagerly anticipated that event since the very start of my career, which was when Greenspan dropped rates to stimulate the economy after the dot com bubble bust recession of the early 2000s.

And even AFTER that massive undertaking we all endured last year, our clients’ long term average return is still ahead of target as of today, and we have plenty left to work with as we start to see what this new normal actually behaves like in the markets.

Why? See points #1 and #2 above.

We are more than likely going to have a once-in-a-many-generations year for bonds, and a lot of upside on stocks as well. The smart money knows we are likely going to have a recession, but recession is not a four-letter word. Don’t fear it, walk through it. Read that like “you might have to run in the rain for a bit, but don’t worry you are covered.” Recessions, just like bear markets, are ALSO an essential organic element in a never-ending cycle.

As your wealth coaches, here are the scenarios as we see them from here:

1. The bull case – Inflation falls, rates drift lower, earnings accelerate on the back half of the year, markets rock-and-roll

2. The sideways market – short term bearish, longer term bullish and not wanting to miss the upside

3. The bear case – the labour market runs too hot, forcing the fed to increase rates further or else inflation returns, and we’re falling/retesting lows

And no matter which of these cases happens, all three of the timeless truths above still hold true.

1. The plan is always the boss (and you are the boss of the plan)

2. Right tool for the job

3. Bear markets, and recessions, are essential organic elements in a never-ending cycle.

When you partner with Surround, no matter what your view is, we have both a methodology and a mindset to keep you on course for the goals we first planned together when we met. Those are the conversations that matter for you as wealth athletes, and for you as families and people. Money is not wealth. Great habits and peace of mind, now that’s wealth.

Gillian Stovel Rivers, MA, CFP®, CEA

Senior Wealth Advisor

Assante Financial Management Ltd.