The Surroundup

TEMPER YOUR EXPECTATIONS

- by Adil Mohammed, CFP®, CIM®, FCSI®

- January 30, 2025

Let me start by wishing you all a very Happy 2025!

Hope everyone had a wonderful holiday season with an opportunity to relax, unplug, and spend time with friends and family. As I write this, my birthday was a couple of days ago, so I thought I’d start by sharing a few candid photos of the crew:

Okay, on to business…

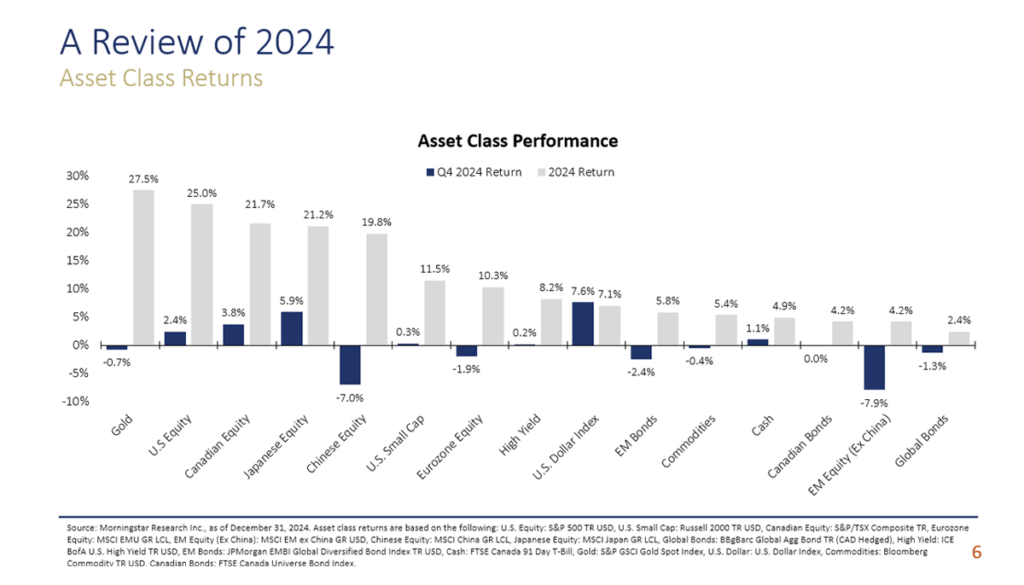

2024: The Everything Rally

Well, another year in the books. If you didn’t like financial markets in 2024, then there’s not much hope for you. Markets were up double digits with no major volatility. Something that doesn’t happen very often. If 2022 was called “the Great Inflation,” and 2023 was labeled “Better than Expected,” then 2024 should be known as “The Everything Rally.”

You name it, and it was up…

- US stocks – up over 20%

- Canadian stocks – up over 20%

- Gold – up over 20%

- China – up 20%

- Europe – up over 10%

- US Small cap – up over 10%

- Bitcoin – up 120%

In fact, the US market made 57 all-time highs last year, which was the fifth most ever and the most since 2021. What’s even more impressive – these returns were achieved without a meaningful downturn. 2024 was as easy as it’s going to get. Not to mention that this is actually the second year in a row of 20%+ returns in the US and double-digit returns in Canada. So we’ve had two back-to-back years of stellar performance.

Why did markets perform so strongly in 2024?

In a nutshell – because things were better than expected.

When it comes to financial markets, it’s less about what happened and more about what people expect to happen. Remember, on the back of a terrible 2022, experts, economists, and market participants came into 2023 super pessimistic. In fact, there was roughly a 100% consensus that a recession was imminent in 2023. Wall Street analysts actually called for an outright fall in the stock market in 2023, the first time this century they predicted a loss.

What happened?

It turned out to be one of the greatest years on record for the US market.

What about 2024?

Again, Wall Street consensus predicted a meager 2% upside move.

What happened?

The US had above-trend growth, a strong labor market, a consumer who continued to spend, inflation under control, central banks cutting rates, and companies earning more money.

Ultimately, the economy proved far more resilient than most expected at the beginning of the year. And thus, another strong year of market performance.

So what can we expect for 2025?

2025: Temper Your Expectations

If I had to give one piece of advice going into 2025, I would say “temper your expectations.”

Why? Let’s start with the history…

History:

After back-to-back years of double-digit returns, it’s unlikely markets will repeat their performance of 2023 and 2024. Going back to 1928, there have only been three other instances of 25%+ gains for the US market in back-to-back years. In other words, the strong market returns of 2023 followed by the equally strong returns in 2024 are already very rare. So to expect this to happen again in 2025 is a bit unrealistic.

That said, I’m not saying markets are going to fall. In fact, history shows that after two years of 20%+ gains, the following year is higher 75% of the time. However, the third year in a bull market (i.e., 2025) tends to have lower returns than year 1 (2023) and year 2 (2024). Plus, if you look at the history of new highs, there have been six other years that had 50 or more all-time highs, and the average return the following year was basically flat (-1.5%). I know history is simply a guide and not the rule, but it should be enough to help temper your expectations.

Speaking of expectations…

Remember when I mentioned expectations were quite low coming into 2023 and 2024? Well, both Wall Street analysts and retail investors have learned their lesson, making sure they do not underestimate the economy’s potential, and as a result, are coming into 2025 quite optimistic. This means that expectations are high, leading to a lot of good news being priced into the market and thus creating a higher hurdle to exceed those expectations. In other words, the margin for error is now smaller should something not go according to plan.

And finally, the macro environment…

Many of the drivers that propelled markets in 2024 will continue into 2025, such as a growing economy and strong company earnings, with very few expecting a recession. However, with a new administration in the US combined with a shakeup in Canadian politics, comes uncertainty. That doesn’t necessarily mean it’s bad for markets, but we should expect that we will be in for a bumpier ride compared to 2024.

So if we combine all three: history, market expectations, and the macro environment, we should expect a softer year.

And after two years of fantastic returns, I’d argue that’s a good thing.

Adil Mohammed, CFP®, CIM®, FCSI®

Wealth Advisor

Assante Financial Management Ltd.

https://www.carsongroup.com/insights/blog/what-happens-after-stocks-gain-20/

https://awealthofcommonsense.com/2025/01/2024-it-was-another-good-year-in-the-stock-market/

The opinions expressed are those of the author and not necessarily those of Assante Financial Management Ltd. This material is provided for general information and the opinions expressed and information provided herein are subject to change without notice. Every effort has been made to compile this material from reliable sources however no warranty can be made as to its accuracy or completeness. Before acting on the information presented, please seek professional financial advice based on your personal circumstances.