The Surroundup, Videos

THE RISE AND FALL AND RISE AND FALL… AND RISE (FOR NOW), OF BITCOIN.

- by Gillian Stovel Rivers, MA, CFP®, CEA

- March 26, 2024

Have you seen Bitcoin’s price lately? It’s skyrocketing!

For good reason, this has raised the interest level of many clients to ask why, and when it might be a good time to consider cryptocurrency as part of a diversified investment strategy. At the same time, many are still cautious about investing in it just yet.

Bitcoin’s surge is undoubtedly impressive, but it’s essential to understand the factors driving it as well as the extent of historical losses as well. Comparing crypto losses in 2022 to other bear markets in history, it’s essential to note that cryptocurrencies are relatively young compared to traditional financial markets. However, the crypto market has experienced significant downturns in the past, such as the bear market of 2018.

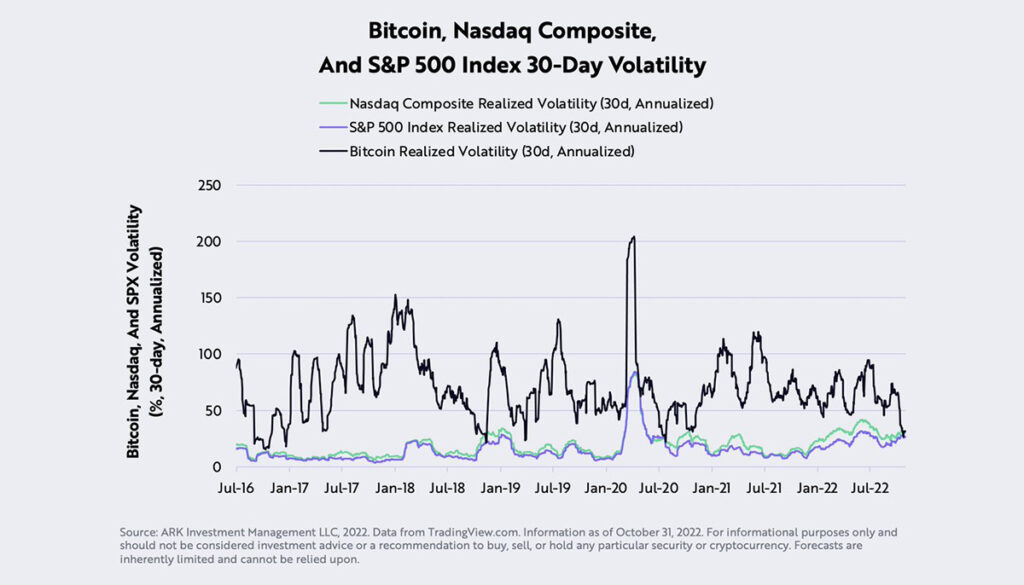

With all of its ups and downs, Bitcoin volatility can be influenced by various factors, including:

- Market Sentiment: Investor sentiment and perceptions of Bitcoin’s value can greatly impact its price fluctuations.

- Regulatory News: Changes in regulations or government policies regarding cryptocurrencies can lead to volatility as investors react to new information.

- Technological Developments: Updates or innovations in blockchain technology, Bitcoin’s underlying technology, can affect its perceived value and thus its volatility.

- Macroeconomic Factors: Economic indicators, inflation rates, and geopolitical events can influence Bitcoin’s volatility as investors seek alternative assets or hedge against traditional market risks.

- Adoption and Acceptance: Increased adoption by businesses, institutions, and individuals can lead to greater stability, while setbacks or negative news regarding adoption can increase volatility.

- Market Manipulation: The relatively small size of the cryptocurrency market compared to traditional markets can make it susceptible to manipulation, leading to abrupt price movements.

- Supply and Demand Dynamics: Bitcoin’s fixed supply and fluctuations in demand can lead to price volatility as supply and demand imbalances occur.

- Technical Factors: Trading volume, liquidity, and trading patterns on exchanges can also contribute to Bitcoin’s volatility.

Overall, Bitcoin’s volatility is influenced by a complex interplay of factors, including both fundamental and speculative elements. But notice NONE of those factors has to do with fundamental needs and wants of human beings, making it an unusually sensitive asset class and therefore more volatile than most.

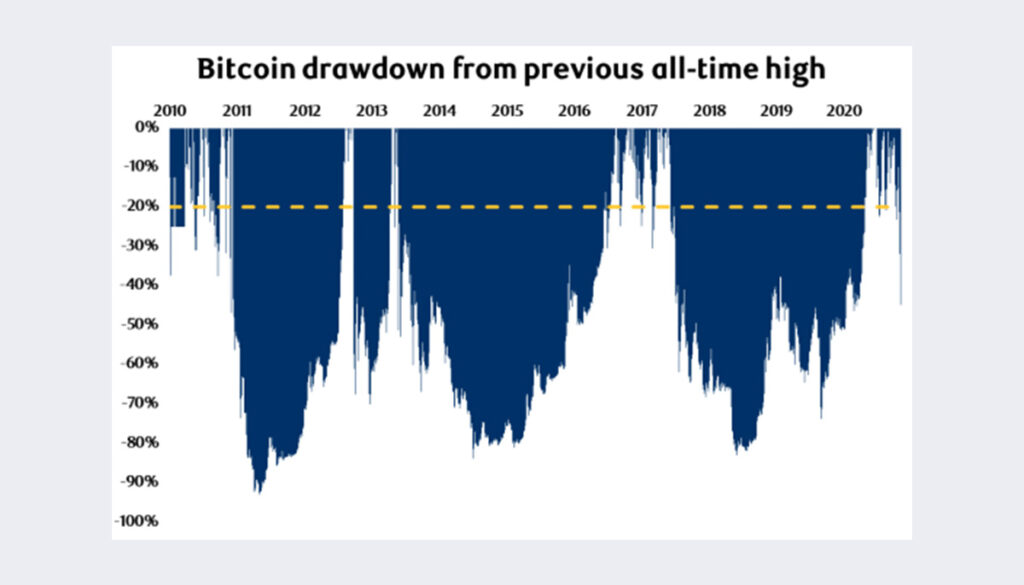

Don’t get me wrong: if you had somehow invested something, anything, in BTC in 2013, and held on to it through every one of the ups and downs in this graph, you would have well more than your started with. But the investing psychology, let alone the practicalities of drawing off an investment that can be down as much as 90%, is unimaginable.

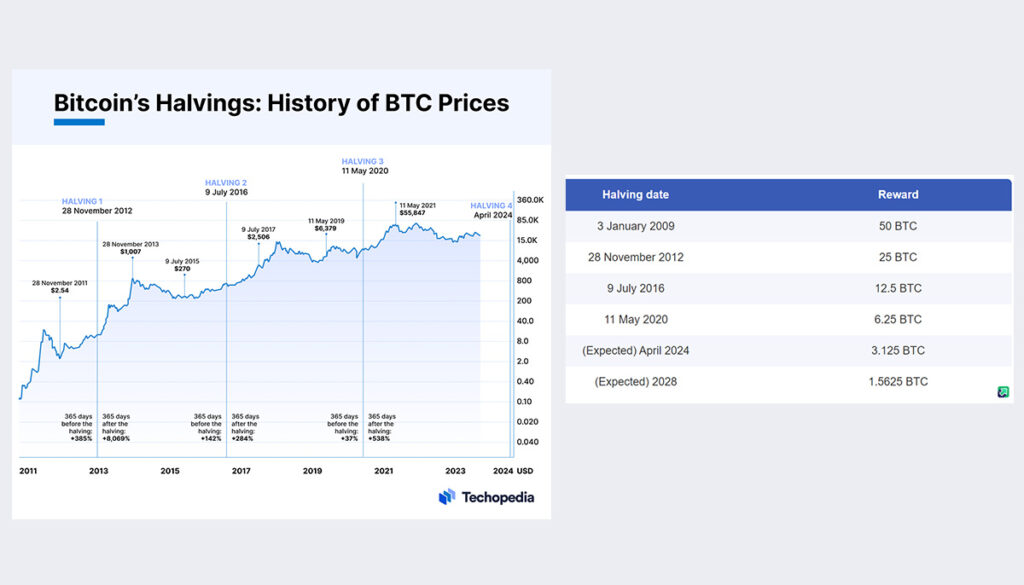

In addition to the factor listed previously, there’s also something called “the halving event”, which sounds like something right out of The Hunger Games.

In actual fact, the Bitcoin halving event is a predetermined reduction in the reward miners receive for validating transactions on the Bitcoin network. It occurs approximately every four years and results in cutting the reward for mining new coins, in half.

This event is designed to control inflation and regulate the supply of Bitcoin. This has a significant bearing on Bitcoin’s recent surge in price, but also seems to be the only thing that is truly affecting it’s questionable value. Until there is widespread acceptance of it as an actual currency, it is hard to argue that amassing it the same way one might amass gold or US dollars.

With inflation concerns and economic uncertainty, many see Bitcoin as a hedge against traditional currencies, but still, we at Surround Wealth Advisors at Assante Financial still have a hard time putting an absolute value on something with no underlying asset, and a short history of intense extreme volatility.

At times like these, it’s important to remember a few of our beliefs about prudent wealth management as they apply to newfangled ideas that may still in fact be too good to be true:

- Small details are a huge deal – With immature asset classes like crypto, the smallest change by the banking lobby or by governments could wipe out the value of all cryptocurrencies. Until such details are encoded in law, it makes sense to play it safe with your investments away from things that could pose extreme harm to your hard-earned wealth.

- Clarity gives you control – Clearly understanding the details and what drives value both up down in your portfolio is critical to the sleep at night factor. If it’s too good to be true, that’s not exactly a feeling of clarity or control now, is it?

- What we do equals what we get – There is no free lunch, and any kind of investment that could easily be mistaken for gambling has a high probability of turning out a lot like gambling – no control and absolute loss. That’s not a healthy part of an investment policy.

As exciting as it sounds, Bitcoin’s volatility is a double-edged sword. Its price can swing wildly, leading to significant gains, but also massive losses. It’s crucial to be well-informed and in the case of crypto currency in particular at this juncture, only invest what you could truly afford to lose. Clearly this is a very different asset class than the ones we otherwise believe in for the management of your hard-earned wealth and future retirement reserves.

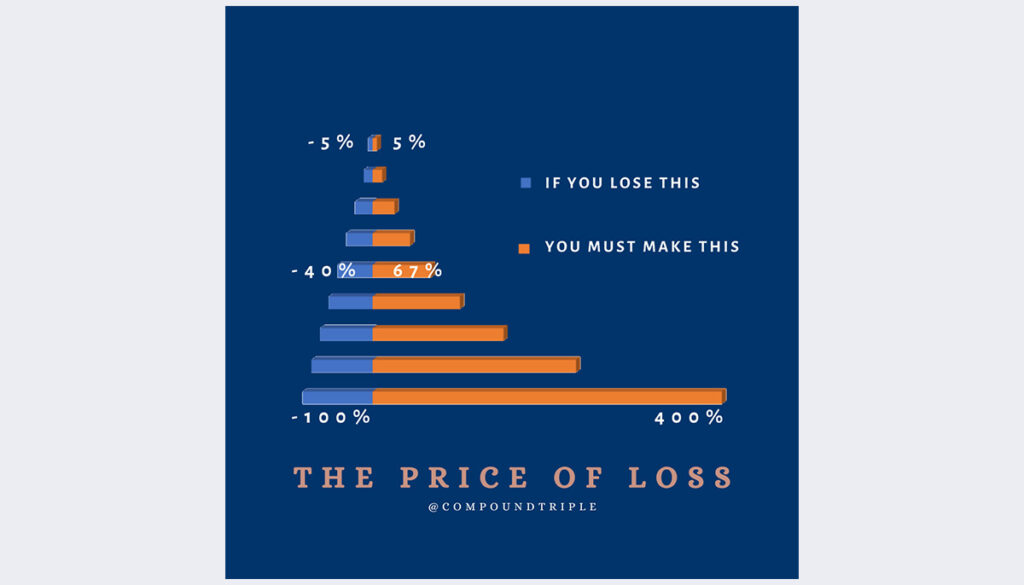

Losing money in the stock market can have both financial and psychological costs. Financially, when you lose money, you not only lose the initial investment but also potential future gains that money could have generated. Psychologically, it can lead to stress, anxiety, and a loss of confidence in investing.

The amount of gain it takes to recover from a loss in the stock market depends on the extent of the loss. For example, if you lose 20% of your investment, you’ll need a gain of 25% to break even. However, the longer it takes to recover, the more you lose out on potential compounding gains. So, it’s crucial to have a solid investment strategy and risk management plan to minimize losses and maximize gains over the long term.

Investing in Bitcoin requires careful consideration and risk management. It’s not a get-rich-quick scheme, despite the hype surrounding it. Diversification and thorough research are key to navigating the volatile world of cryptocurrencies.

By Gillian Stovel Rivers, MA, CFP®, CEA

Senior Wealth Advisor

Surround Wealth Advisors

Assante Financial Management Ltd.

This material is provided for general information and should not be considered individual investment, tax, accounting, or legal advice, or construed as an offer or solicitation to buy or sell securities. The statements and opinions expressed are those of the presenter(s) and not necessarily those of Assante Financial Management Ltd. All opinions expressed and information provided herein are subject to change without notice. Every effort has been made to compile this material from reliable sources as at the date indicated however, no warranty can be made as to its accuracy or completeness Market conditions may change which may impact the information contained herein. All charts and illustrations in this document are for illustrative purposes only and they are not intended to predict or project investment results. In considering any particular investment or investment strategy, please remember that past performance is no guarantee of future performance. The information contained herein may not apply to all types of investors. Before acting on the information presented, please seek professional financial advice based on your personal circumstances.