Blog

Update on the Russia and Ukraine Situation

- by Adil Mohammed, CFP®, CIM®, FCSI®

- February 24, 2022

With the recent escalation of tensions between Russia and Ukraine causing market uncertainty, we wanted to share with you commentary received from Drummond Brodeur, Senior Vice-President, Portfolio Manager and Global Strategist at CI Global Asset Management.

“The Russia/Ukraine situation remains fluid and will likely continue to deteriorate with a series of escalating actions from Russia matched by sanctions from the west. This will continue to dominate headlines and be a driver of market volatility in the coming days and weeks and we are monitoring the unfolding situation. But for markets, we maintain the most important factor remains the pace of the Fed’s removal of policy accommodation and the related trajectory of incoming inflation data.

Russian and Ukrainian hostilities, while geopolitically significant, are unlikely to have a significant impact on broader global economic fundamentals that ultimately drive market returns. The U.S. and other developed economies are seeing robust demand as the reopening resumes after the recent omicron headwinds.

It is this strong underlying demand, coupled with elevated inflation numbers (stemming from supply chain disruptions) compelling the Fed to accelerate the removal of monetary policy accommodation. The Fed will be increasing interest rates toward the neutral rate at a faster pace than it had previously anticipated, along with commencing the rundown of its balance sheet. It is this pivot and associated uncertainty surrounding the monetary policy path that remains the most critical factor for markets. While the Russia/Ukraine situation can amplify near term market volatility and behaviour, it is unlikely to have a measurable impact on these underlying fundamentals. It is also unlikely to alter the evolving view from the Fed on its path forward.

Beyond headline driven sentiment, one potential avenue for contagion is through energy prices and this can already be seen in their recent strength. While this may aggravate some inflationary pressures, it is unlikely to be sufficient to offset the current economic momentum, but is likely more of a headwind in Europe than the U.S.

Speaking specifically about the CI Global Income and Growth Fund, it was our expectation of the need for markets to reprice a more aggressive Fed tightening cycle that led us to reduce our equity exposure in late December. This has been the main cause of market weakness since the start of 2022. Should we see further geopolitically influenced weakness in coming weeks we would add to our equity holdings.”

You can read the full commentary by clicking on the following link:

Update to the Russia/Ukraine situation – Drummond Brodeur – February 2022

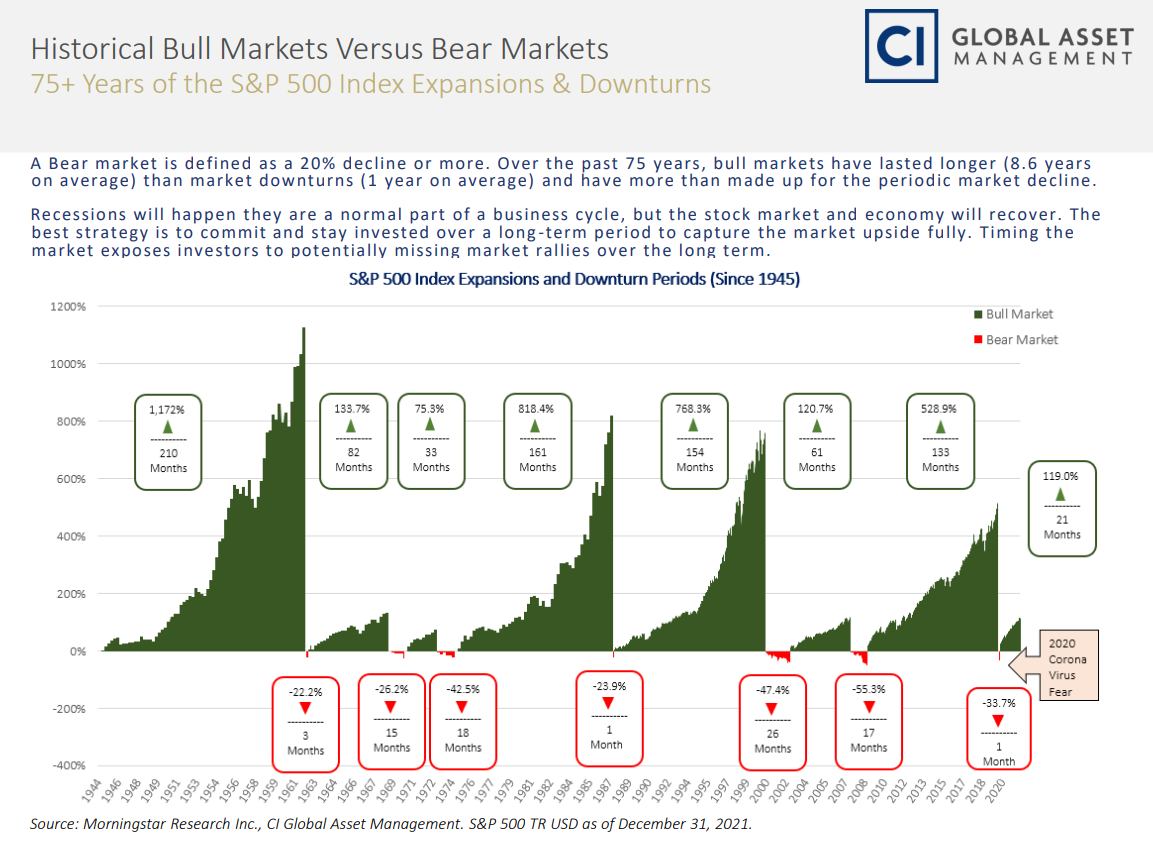

As always, we’d like to leave you with some market perspective, this time as it relates to bull markets vs bear markets.

Our Clarity Gives You Control

We understand that the start of the 2022 hasn’t been easy and as always we’re here and available if you’d like to chat.

Talk soon, on behalf of the entire team at Surround,

Adil Mohammed, CFP®, CIM®, FCSI®

Wealth Advisor

Assante Financial Management Ltd.